Tokyo Stock Exchange

12:29 JST, December 17, 2024

TOKYO (Reuters) – Japan’s Nikkei share average rose on Tuesday, underpinned by the Nasdaq’s gains overnight and a weak yen, although caution set in ahead of central bank policy decisions in the U.S. and Japan.

The Nikkei had climbed 0.16% to 39,520.06 by the midday break, while the broader Topix was up 0.01% at 2,738.73.

“Investors refrained from taking active bets as they were cautiously awaiting the central banks’ policy decisions,” said Shuutarou Yasuda, a market analyst at Tokai Tokyo Intelligence Laboratory.

The Nasdaq closed at a record high on Monday and the S&P 500 also rose as investors gauged the latest economic data while looking toward the Federal Reserve’s final policy announcement of the year later in the week to gauge the path of interest rates.

The Fed is set to conclude its two-day policy meeting on Wednesday, with markets pricing in a 95.4% chance for a cut of 25 basis points (bps), according to CME’s FedWatch Tool.

The yen was subdued on Tuesday, as markets have pared chances of a Japanese rate hike this week and see a move in January as more likely.

The Bank of Japan will announce its policy decision on Thursday and a majority of economists expect it to hold rates steady at 0.25%. Swap rates indicated a 21.7% chance of a 25-basis-point hike.

A weak yen benefits Japanese exporters, as it inflates the value of overseas sales.

SoftBank Group rose 3.83% after U.S. President-elect Donald Trump said the technology start-up investor would invest $100 billion in the U.S. over the next four years.

Zojirushi surged 12.88% to become the top gainer on the Tokyo Stock Exchange’s prime market after the household appliances maker raised its operating profit forecast for the year to November.

Chip-testing equipment maker Advantest fell 4.6% to become the worst percentage loser on the Nikkei.

Top Articles in News Services

-

Prudential Life Expected to Face Inspection over Fraud

-

Arctic Sees Unprecedented Heat as Climate Impacts Cascade

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Suzuki Overtakes Nissan as Japan’s Third‑Largest Automaker in 2025

JN ACCESS RANKING

-

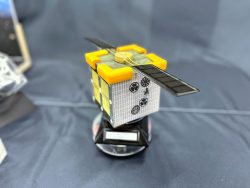

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.