Bank of Japan May Hold off on Interest Rate Hike; Results of Spring Wage Negotiations, U.S. Policy May Impact Decisions

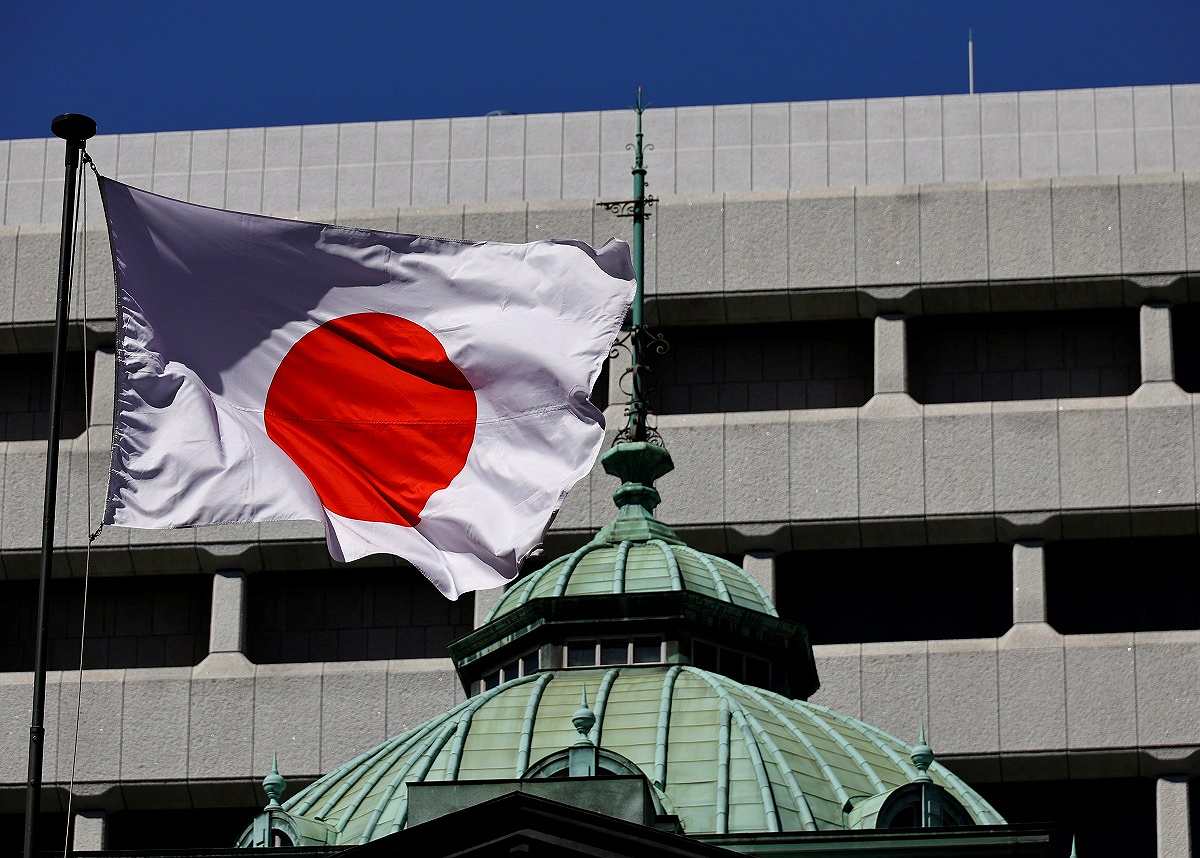

Japan’s national flag flutters atop the Bank of Japan (BOJ) building in Tokyo.

7:00 JST, December 15, 2024

The Bank of Japan may hold off on a further interest rate hike at its Monetary Policy Meeting to be held on coming Wednesday and Thursday.

There is a growing view within the central bank that it is necessary to carefully assess results of the 2025 shunto spring wage negotiations before making another interest rate hike, although central bank policymakers think the economy and prices have moved in line with the bank’s projections.

The BOJ believes that achieving its 2% inflation target will require wage increases at a level similar to those seen in the 2024 shunto negotiations. In its view, the probability of achieving its target will increase if it can confirm wage increase trends before making a policy decision.

In the market, too, there is a growing view that the BOJ will hold off on raising interest rates at the December meeting. On Friday, the yen weakened against the dollar, briefly reaching the mid-¥153 range, as the foreign exchange market saw no significant change in the interest rate differential between Japan and the United States.

At its July meeting, the BOJ decided to raise its policy interest rate to around 0.25%. BOJ Gov. Kazuo Ueda said at the time, “If the economic and prices move in line with our projection, we will continue to raise interest rates.”

The BOJ’s Tankan quarterly economic survey for December, released on Friday, also showed that business sentiment was firm. The environment for an additional interest rate hike is gradually being established, but several senior BOJ officials argue that there is no need to rush to raise interest rates unless there is an acceleration in price rises.

On Tuesday and Wednesday, just prior to the BOJ making its decision on monetary policy, the U.S. Federal Reserve Board will hold a Federal Open Market Committee meeting. Although the market is certain that the Fed will lower its policy rate by 0.25 points, the number of rate cuts expected for next year and beyond, as well as market movements, could also have an impact on the BOJ’s policy decision.

Top Articles in Business

-

Japan, Italy to Boost LNG Cooperation; Aimed at Diversifying Japan’s LNG Sources

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Asics Opens Factory for Onitsuka Tiger Brand in Western Japan

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

KDDI Opens AI Data Center at Former Sharp Plant in Osaka Prefecture; Facility Will Provide Google’s Gemini AI Model for Domestic Users

JN ACCESS RANKING

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture