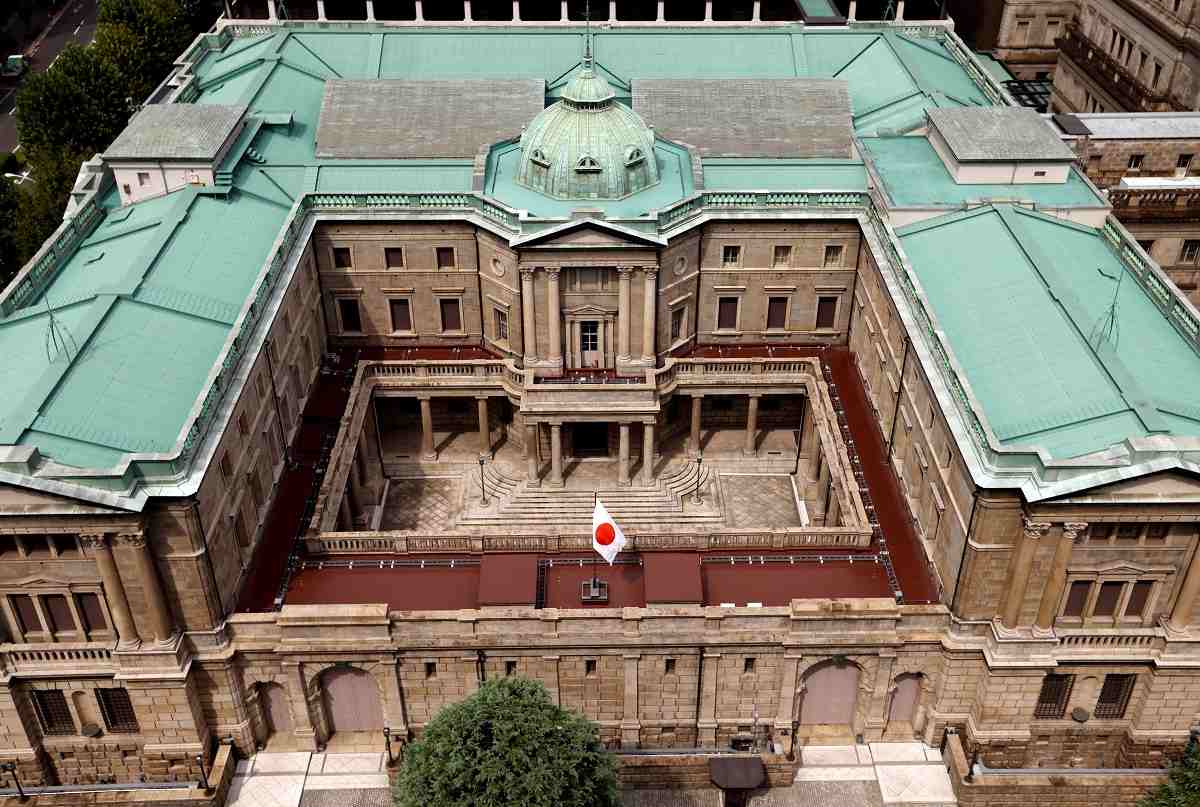

The Bank of Japan is seen in Tokyo in September 20, 2023.

17:39 JST, March 26, 2024

TOKYO (Reuters) – Japan’s business-to-business service prices continued to rise steadily but a key measure of trend inflation slowed in February, painting a mixed picture on the price outlook that may complicate the central bank’s interest rate hike path.

The services producer price index, which measures what companies charge each other for services, rose 2.1% in February from a year earlier, data showed on Tuesday, unchanged from January in a sign companies continued to pass on labor costs thanks to prospects for sustained wage gains.

The data underscores the BOJ’s view that rising service prices will replace cost-push inflation as a key driver of price gains, and help sustain inflation around its 2% target.

But separate data released on Tuesday showed Japan’s weighted median inflation rate, which is closely watched as an indicator on whether price rises are broadening, slowed to 1.4% in February from 1.9% in the previous month.

The trimmed mean inflation rate, which excludes the 10 highest and lowest tail of the price distribution, hit 2.3% in February, slowing from 2.6% in January and marking the lowest year-on-year increase since September 2022, the data showed.

The Bank of Japan ended eight years of negative interest rates and other remnants of its unorthodox policy last week, making a historic shift away from decades of massive stimulus that was aimed at reviving the economy.

BOJ Governor Kazuo Ueda has said the timing of future interest rate hikes will depend largely on whether trend inflation will move closer to the bank’s 2% target.

"News Services" POPULAR ARTICLE

-

American Playwright Jeremy O. Harris Arrested in Japan on Alleged Drug Smuggling

-

Japan’s Nikkei Stock Average as JGB Yields, Yen Rise on Rate-Hike Bets

-

Japan’s Nikkei Stock Average Licks Wounds after Selloff Sparked by BOJ Hike Bets (UPDATE 1)

-

Japan’s Nikkei Stock Average Buoyed by Stable Yen; SoftBank’s Slide Caps Gains (UPDATE 1)

-

Japanese Bond Yields Zoom, Stocks Slide as Rate Hike Looms

JN ACCESS RANKING

-

Keidanren Chairman Yoshinobu Tsutsui Visits Kashiwazaki-Kariwa Nuclear Power Plant; Inspects New Emergency Safety System

-

Imports of Rare Earths from China Facing Delays, May Be Caused by Deterioration of Japan-China Relations

-

University of Tokyo Professor Discusses Japanese Economic Security in Interview Ahead of Forum

-

Tokyo Economic Security Forum to Hold Inaugural Meeting Amid Tense Global Environment

-

Japan Pulls out of Vietnam Nuclear Project, Complicating Hanoi’s Power Plans