The Tokyo Stock Exchange

10:20 JST, September 8, 2025

TOKYO, Sept 8 (Reuters) – Japan’s stocks surged, the yen weakened and bonds stood firm on Monday after Prime Minister Shigeru Ishiba’s resignation stoked speculation that his successor will raise government spending.

The Nikkei 225 index .N225 gained 1.7% to 43,740.15, while the broader Topix .TOPX rose 1% to a record high. The yen softened 0.7% to 148.46 JPY=EBS versus the U.S. dollar.

The benchmark 10-year Japanese government bond (JGB) yield rose 0.5 basis point (bp) to 1.575%. The five-year yield slid 0.5 bp to 1.1%.

Yields on super-long JGBs hovered near record highs due to global concerns about fiscal deficits and as pressure mounted on Ishiba from within his Liberal Democratic Party (LDP), while the Nikkei recently slipped from last month’s record high.

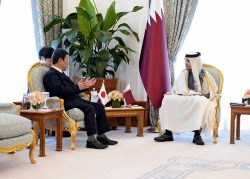

Among top contenders in the LDP leadership race is Sanae Takaichi, a devotee of “Abenomics” policies of Shinzo Abe – Japan’s long-time leader and former PM, who presided over massive stimulus and unprecedented monetary easing.

“Sanae Takaichi, who is considered to have a strong expansionary fiscal bias, could be perceived as more positive for Japanese equities,” Morgan Stanley and MUFG Securities analysts, including Takeshi Yamaguchi, wrote.

“The risk of her favoring excessively dovish monetary policy appears lower than last year.”

Meanwhile, Takaichi has largely been seen as bad news for Japan’s already stressed bond market.

“She’s known to favor stimulus measures and is viewed as wanting the Bank of Japan (BOJ) to take a cautious stance on policy, so that wouldn’t be a great outcome for bond markets,” Skye Masters, head of markets research at National Australia Bank, said in a podcast.

Ishiba’s relatively conservative fiscal stance has been seen as a positive for the JGB market, where yields are relatively low globally, though Japan’s massive debt pile and widening fiscal deficits continue to raise concerns.

The country’s outstanding debt stands at nearly 250% of its gross domestic product (GDP), the highest among developed economies. Budget requests for the next fiscal hit a record for the third straight year, the finance ministry said last week.

The JGB market was dealt a blow in mid July, when Ishiba’s coalition suffered a considerable defeat in upper house polls. Outsider parties, campaigning on tax cuts and increased spending, gained seats, and speculation swirled for weeks about pressure on Ishiba to step down.

That all came to a head on Sunday, with Ishiba, saying he must take responsibility for election losses and instructing the LDP to hold an emergency leadership vote.

The Nikkei share index hit a record high of 43,876.42 on August 19, riding a wave of optimism for corporate governance reforms and investment in artificial intelligence.

Analysts in a Reuters poll see the index easing off that level to 42,000 by year end.

Top Articles in News Services

-

Arctic Sees Unprecedented Heat as Climate Impacts Cascade

-

Prudential Life Expected to Face Inspection over Fraud

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Japan’s Nagasaki, Okinawa Make N.Y. Times’ 52 Places to Go in 2026

JN ACCESS RANKING

-

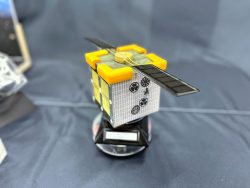

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time