MHI Changing Tack 1 / MHI working to depart from traditional style of ‘composite management’

Mitsubishi Heavy Industries Ltd. President Seiji Izumisawa

12:32 JST, March 31, 2021

Mitsubishi Heavy Industries Ltd. (MHI) is at a turning point.

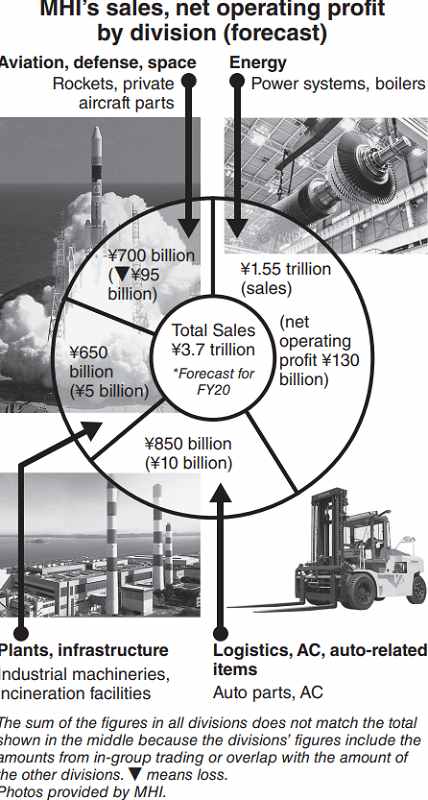

The company, whose history dates back to 1884, is scaling back its moneymaking thermal systems and original shipbuilding business, and working to move into renewable energy. Expanding its businesses into a wide range of fields, including fighter jets and rockets, where is this well-known firm heading?

This is the first installment of a series examining the business and future prospects of MHI.

“We’ve been providing products in unexplored fields, including land, sea, air, space and deep sea, and now will make use of the technologies we’ve accumulated,” President Seiji Izumisawa, 63, vowed in October last year when announcing MHI’s three-year business plan from fiscal 2021.

At Izumisawa’s initiative, the business plan was compiled six months ahead of schedule, and clearly states the policy of downsizing MHI’s mainstay coal-fired thermal power, commercial aircraft and shipbuilding businesses.

Staffing in the commercial aircraft division will be cut by half, while that in shipbuilding will be reduced by 25%. The number of staff in coal-fired thermal power will also be reduced by 20% by fiscal 2024. The plan further includes the reallocation of about 3,000 employees in Japan.

“We needed to send a message to our employees as soon as possible that the direction we are aiming for is changing,” said Chief Strategy Officer Hitoshi Kaguchi, 61, who was in charge of compiling the plan.

MHI executives gathered at its headquarters in Tokyo’s Marunouchi business district every Saturday from September to October to work out the plan.

Until around 2018, the dominant thinking within MHI was that it could still make money from thermal power generation, particularly in emerging economies. However, the atmosphere began to change in 2019, and the sense of urgency grew in 2020 to quickly launch an energy conversion plan with an eye toward a decarbonized society.

Traditionally, MHI has pursued “composite management,” conducting a wide range of business. With this system, a slump in one business can be made up by others. At the same time, it is hard to identify the core business that supports corporate growth.

Under its new business plan, MHI will invest ¥180 billion in the development of technologies to support renewable energy and automated driving.

“We’ll determine the direction of growth from our maturing businesses,” Izumisawa said.

History of manufacturing

MHI’s history overlaps with that of Japan’s manufacturing industry.

The company was in charge of the development and production of Zero fighters, the leading aircraft at the time of World War II. The battleship Musashi was built at its Nagasaki Shipyard & Machinery Works. After the war, MHI produced the manned submersible research vessel Shinkai 6500 and a rocket that carried the Himawari weather satellite into space. MHI is one of the most prestigious companies to support Japan since the Meiji era (1868-1912).

However, there have been problems with its business performance, and it has notable weaknesses.

For example, development of the Mitsubishi SpaceJet, a domestically produced jet airliner, has stalled. MHI also incurred a deficit of about ¥250 billion in the construction of large passenger ships ordered by overseas companies. In nuclear power plant construction, which is one of its main businesses, MHI’s most recent project is Hokkaido Electric Power Co.’s Tomari No. 3 reactor, which began commercial operations in 2009.

Then came the coronavirus pandemic. Against a slump in passenger demand, MHI suffered a rapid decline in the sale of aircraft parts, including main wings, to be shipped to leading U.S. airplane maker Boeing.

As a result, MHI’s consolidated net profit for the April-December period of 2020 was ¥3.3 billion, down 96.7% from the same period previous year. The company was on the verge of falling into the red.

Low profits

MHI had been suffering low growth even before the pandemic.

Over the past 30 years, the company’s sales grew 80%, from ¥2.28 trillion in fiscal 1989 to ¥4.04 trillion in fiscal 2019. This was fueled mainly by the acquisition of businesses such as forklifts and steelmaking machinery, which did not boost profit margins.

Over the past five years, the percentage of its net operating profit (business profit until fiscal 2017) to net sales has averaged about 3.5%, which is not as good as the steady 7% earned by Hitachi Ltd.

The financial market casts a stern eye toward MHI. The company’s market capitalization value continues to hover in the low ¥1 trillion range.

“The profit margin is low. If the company can’t demonstrate its future potential, investors will turn their back,” Daiwa Securities Co. analyst Hirosuke Tai said.

An unshackled president

Izumisawa, who became president in 2019, has long been engaged in assessing the future potential of advanced technologies. Unlike past presidents, who were promoted within a single division to become the top manager, Izumisawa is not shackled to any one section. He is determined to achieve a 7% business profit margin by fiscal 2023 and has expressed his commitment both in and outside the company.

In February of this year, Izumisawa sent out a message via MHI’s corporate newsletter to 80,000 employees, including those at affiliated companies, saying: “There is no shortcut to achieving our goal. Let’s make steady progress, step by step.”

Head of top 3 branches

MHI handles 500 products, from rockets and power plants to fighter jets, submarines and household air conditioners in its group.

Its original business is shipbuilding, started in 1884 in Nagasaki by Yataro Iwasaki, who hailed from the Tosa domain (modern Kochi Prefecture). The company expanded its business from ships to heavy machinery, aircraft and rolling stock, and changed its name from Mitsubishi Shipbuilding Co. to the current Mitsubishi Heavy Industries in 1934.

With the dissolution of the zaibatsu after the war, the company was split into three entities, and in 1964, the year of the Tokyo Olympics, the three entities merged to make a fresh start. The company expanded its products during the high economic growth period from the early 1950s to the early 1970s, manufacturing 700 products at its peak. In 1970, the automobile division was spun off to become Mitsubishi Motors Corp.

MHI is the head of the Mitsubishi group’s top three branches, along with MUFG Bank Ltd. and Mitsubishi Corp., at Mitsubishi Kinyokai, a fellowship organization of the top management of 26 companies in the group.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan