Japan’s Consumption Tax Cut Pledges Spark Concerns in Restaurant Industry

People walk along a street lined with restaurants in Taito Ward, Tokyo, on Wednesday.

21:00 JST, January 30, 2026

Concerns have been mounting in the restaurant industry over the proposed reduction to the consumption tax rate for food items, which has emerged as a key issue in the upcoming House of Representatives election.

The tax rate on food items, with exceptions including alcoholic beverages, is currently 8%. If it is reduced to zero while the rate on eating out remains at 10%, the gap between the two categories will widen, potentially driving away customers from restaurants.

“If the tax rate on food becomes zero, the difference in the cost of preparing food at home and eating out at restaurants will grow,” said a Japan Foodservice Association official. “This could lead to fewer people eating out, forcing some restaurants to close their businesses.”

Food purchased for takeout has a consumption tax rate of 8%. Many gyudon beef bowl and other fast-food chains set the same price for both eating-in and takeout in order to avoid confusion. In many cases, businesses effectively absorb the 2% difference.

The Liberal Democratic Party has pledged to “accelerate its consideration” to realize a two-year exemption of the consumption tax on food and beverages. The Centrist Reform Alliance proposed a permanent 0% tax rate on food items. If either proposals are implemented, the tax rate gap between takeout and eating-in will widen.

An employee for a major restaurant chain pointed out some of the challenges this would create, saying, “we will have to reevaluate the pricing. The number of customers for takeout will increase, affecting our business strategies. Even if the exemption period is limited to two years, confusion is unavoidable, and the burden on us will be significant.”

It will likely also affect cash flow, particularly for small and mid-sized eating establishments. Under the current system, when receiving payment for meals, businesses can deduct the consumption tax they paid on food items purchased as ingredients from the tax collected from customers, before remitting the difference to the government.

If the consumption tax on food items is reduced to zero, the deductible portion would disappear, so restaurants should be prepared to pay the total tax all at once. Although the total tax burden remains unchanged in theory, businesses would need to prepare more cash for the payments.

Although retailers such as supermarkets anticipate positive effects such as “customers buying more food items and being incentivized to buy more items other than food,” some concerns remain.

“Reprinting the price tags for over 1000 food items will be a big undertaking amid a labor shortage,” said the president of a supermarket chain that operates three outlets in Saitama City. An employee of a major supermarket chain said that “modifying the cash register system will take time and cost money.”

“If the tax reduction is temporary, customers will see food prices rise again when the tax rate is reimposed, and that could make them want to buy less,” the employee added.

Related Tags

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

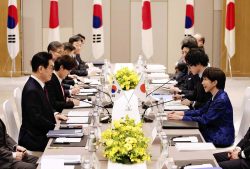

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time