¥122 Tril. Budget for FY26 Fails to Dispel Market Concerns; Curb on Social Security Spending Deemed Insufficient

Prime Minister Sanae Takaichi, center, and other cabinet members attend a cabinet meeting held at the Prime Minister’s Office on Friday.

7:00 JST, December 28, 2025

The fiscal 2026 budget compiled by the administration of Prime Minister Sanae Takaichi includes debt-servicing expenses, such as principal repayments and interest payments, that exceed ¥30 trillion for the first time.

While the administration has advocated for “responsible and proactive public finances,” the budget falls short when it comes to holding down ever-increasing social security expenses. As a result, it is failing to dispel market wariness.

If the administration cannot present a path toward realizing fiscal soundness, interest rates could rise even higher, which would lead to intensified fiscal stringency.

“While also taking fiscal discipline into consideration, we have worked on a budget that will harmonize a strong economy with sustainable public finances,” Takaichi emphasized to reporters on Friday.

Since taking office in October, the prime minister has shown an attitude of prioritizing economic growth over immediate fiscal reconstruction.

As to the primary balance at the national and local governments, Takaichi declared that the annual primary budget surplus target would be abandoned. The supplementary budget for fiscal 2025, which passed earlier this month, swelled to over ¥18 trillion, the largest of the post-pandemic era.

Markets reacted with alert to this expansionary shift in fiscal policy. The yield on newly issued 10-year government bonds, the barometer of long-term interest rates, rose to as high as 2.1%, its highest level in 27 years.

While the yield had hovered at around 1.6% before Takaichi took office, concerns over worsening public finances, coupled with the Bank of Japan’s additional interest rate hikes, led to the yield’s rapid rise over a short period.

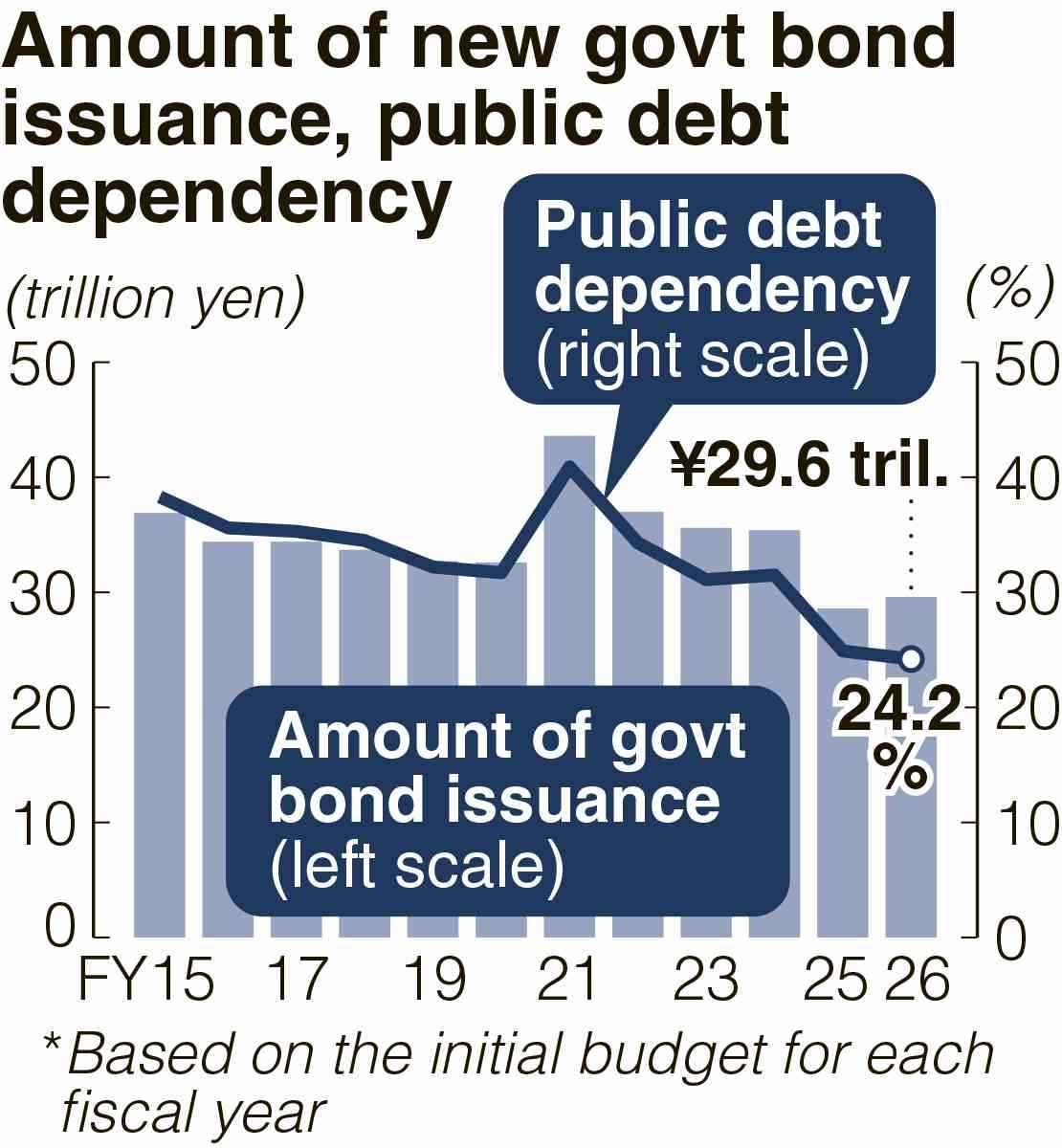

The budget proposal showed some vigilance by limiting new bond issuance to ¥29.584 trillion, below ¥30 trillion for the second consecutive year. The ratio of government debt to total fiscal revenue in the fiscal 2026 budget is at 24.2%, down from 24.9% in the previous year.

Expansion

However, this decline in public debt dependency is closely tied to an increase in tax revenue driven by inflation and expanded corporate earnings.

Reform of social security expenditures, which account for one-third of total spending and represent the “main component” of the budget, remains only halfway through.

Compensation paid to medical institutions to cover labor costs for medical workers, including doctors — the core portion of medical service fees — was increased by more than 3% for the first time in 30 years.

The Finance Ministry initially insisted on an increase in the 0.5% range, but with the prime minister’s decision, the Health, Labor and Welfare Ministry’s request was accepted in full.

While the maximum amount of copayments for patients under the high-cost medical expense benefit system will be raised, the amount is scaled back significantly from the proposal made under the previous administration of then Prime Minister Shigeru Ishiba.

As a result of relevant measures, including the hike to the maximum copayment amount for patients, only about ¥150 billion will be saved. However, social security-related expenses will still increase by ¥760 billion from fiscal 2025. To contain the increase in such expenses driven by an aging population, bold revisions will become inevitable.

Another concern is an increased fiscal burden due to rising interest rates.

In the latest budget compilation, the assumed interest rate — used to calculate interest payment costs on government bonds — was raised by a large margin, from 2.0% per year at the start of fiscal 2025 to 3.0% per year.

Consequently, interest payments for fiscal 2026 will balloon by as much as ¥2.5 trillion compared to fiscal 2025. As the government bonds issued during the years of low interest rates will be replaced with higher interest bonds during refinancing, a surge in interest payments is likely in the future.

In the “Basic Policy on Economic and Fiscal Management and Reform,” which will be finalized in the summer of 2026, the government plans to include a new fiscal reconstruction target to replace the goal of achieving a single-year primary balance surplus.

Those close to the prime minister have emphasized the necessity of spending aimed at economic growth, saying: “Companies would borrow money to invest if it is necessary for their growth. The same applies to the state.”

However, unless the administration presents a responsible fiscal management policy, it could become difficult to make growth-inducing investments.

"Politics" POPULAR ARTICLE

-

Japan to Support Central Asian Logistics Route That Bypasses Russia, Plan to Be Part of Upcoming Summit in Tokyo

-

Chinese, Russian Bombers Flew Unusual Path by Heading Toward Tokyo; Move Likely Meant to Intimidate Japan

-

Japan Plans National Database to Track Foreign Ownership of Real Estate, Land as It Weighs New Rules

-

Up to 199,000 Deaths Estimated From Mega-Tsunami; Most Recent Occurrence Took Place in 17th Century

-

Japan Govt to Soon Submit Lower House Seat Reduction Bill That Could Take Effect in FY27

JN ACCESS RANKING

-

Tokyo Economic Security Forum to Hold Inaugural Meeting Amid Tense Global Environment

-

Keidanren Chairman Yoshinobu Tsutsui Visits Kashiwazaki-Kariwa Nuclear Power Plant; Inspects New Emergency Safety System

-

Imports of Rare Earths from China Facing Delays, May Be Caused by Deterioration of Japan-China Relations

-

University of Tokyo Professor Discusses Japanese Economic Security in Interview Ahead of Forum

-

Japan Pulls out of Vietnam Nuclear Project, Complicating Hanoi’s Power Plans

-250x167.jpg)