Japan Could Expand Tax Credits for Strategic Tech Investments, Eyeing Growth in AI, Semiconductors

The Economy, Trade and Industry Ministry building in Chiyoda Ward, Tokyo

21:00 JST, November 27, 2025

Companies could use up to 40% of their R&D investment for tax credits under a plan for 2026 tax reform proposed by the Economy, Trade and Industry Ministry. The tax credits would be offered specifically for investments in the government’s six “national strategic technologies.”

The proposal to expand the R&D Tax Credit System is aimed at encouraging corporate investment in areas critical for economic security and industrial growth.

Earlier this month, an expert panel under the Cabinet Office announced six fields of technology that need strategic support: artificial intelligence and robotics; semiconductors and communications; space; quantum; fusion energy; and biotechnology and health care.

The ministry also proposed that as much as 50% of expenses be usable as credits for designated joint research with universities or institutions when that research is recognized as superior.

The R&D Tax Credit System allows private companies to deduct a percentage of their research and development expenses from their corporate taxes. There currently are two credit rates depending on the type of expense: up to 14% of total research expenses may be deducted, or up to 30% of expenses for joint or contract research with universities and other institutions, known as “open innovation.” A total of about ¥950 billion was deducted in fiscal 2023 under this system.

Global competition has been intense in critical technologies. In 2024, the United States designated AI, semiconductors and space, among other fields, as critical and emerging technologies and increased support in these areas. Germany launched a new strategy this year to focus investments on core technologies such as quantum, AI and energy. South Korea has introduced a 40% tax credit for investments in semiconductors and batteries.

As the R&D Tax Credit System and similar measures lower corporate taxes under certain conditions, some have argued that they should be scaled back to secure more revenue once the provisional gasoline tax surcharge is ended. The government and ruling parties will discuss the ministry’s plan to expand the credits, but negotiations are expected to be difficult.

Related Tags

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

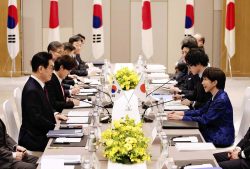

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time