Details of Japan-U.S. Tariff Agreement Disclosed in Joint Statement, Memorandum of Understanding

Economic revitalization minister Ryosei Akazawa, right, shakes hands with U.S. Commerce Secretary Howard Lutnick during a signing ceremony on Japan’s investment in the United States in Washington on Thursday.

8:02 JST, September 7, 2025

Japan and the United States have issued a joint statement and a memorandum of understanding in line with U.S. President Donald Trump signing an executive order to lower tariffs on Japanese automobile imports and other products.

The documents state what the two countries agreed upon in July about Japan accepting more U.S. imports and investing $550 billion (about ¥80 trillion) in the United States in exchange for lower tariff rates.

However, the Trump administration is ready to increase tariffs if Japan fails to follow through on the commitment, raising the possibility that the two countries may return to the bargaining table.

“The U.S. side seemed to want to create the documents to reconfirm the commitment between Japan and the United States,” economic revitalization minister Ryosei Akazawa told reporters in Washington on Thursday. “[The documents] are significant from the viewpoint that they make detailed and careful explanations to the public.”

Initially, Japan did not think the documents were necessary. However, as a result of discrepancies between the two countries’ explanations about Japanese investment in the United States, Japan agreed to creating the documents on the condition that Trump signs an executive order.

The joint statement lists details of the agreement, which Trump expects will contribute to reducing the U.S. trade deficit and resuscitating the U.S. economy.

Regarding U.S. energy, the statement specifies how much Japan will procure for the first time.

It states that Japan will make stable incremental purchases of energy from the United States, including liquified natural gas, over a long period of time, totaling $7 billion per year.

A senior official of the Economy, Trade and Industry Ministry said it was a realistic commitment.

JERA Co., Japan’s largest energy producing company, was also positive about the agreement.

“U.S.-produced LNG is competitively priced, so it will be possible to purchase it under favorable conditions, making it easier for us to resell it,” a JERA official said.

The joint statement also says that Japan will increase imports of U.S. rice by 75% within the duty-free import quota called “minimum access.” The government plans to allocate rice import quantities from Thailand and Australia to the United States in an effort to curb the impact on domestic farmers.

Committees to suggest projects

The memorandum of understanding states that Japan will invest $550 billion in the United States by Jan. 19, 2029, which is the end of Trump’s second presidential term.

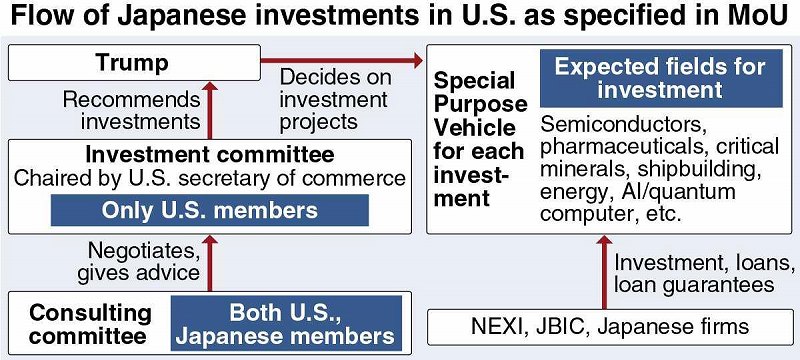

On selecting investment projects, the memorandum states that an investment committee, which will be chaired by the U.S. secretary of commerce, will recommend projects that will then be selected by the president. The investment committee will have no Japanese members.

Japan plans to make the funds available through investments, loans and loan guarantees by Japan Bank for International Cooperation, Nippon Export and Investment Insurance, and other institutions.

While Japan will be a part of a consulting committee, which will advise the investment committee, it will be difficult for Japan to change the investment projects that are selected by Trump. As a result, the entire process could proceed under U.S. direction.

The memorandum also states that if Japan fails to provide the funds, the United States can impose new tariff rates on Japanese imports.

U.S. Commerce Secretary Howard Lutnick said that Trump has “complete discretion” over where the Japanese investments will go, in an interview with CNBC television.

Kazuma Maeda, economist at Dai-ichi Life Research Institute, says it is unclear whether details of Japan’s investments in the United States are recognized differently between the two countries.

“The mechanism of entrusting decisions to President Trump, who would make such decisions as imposing additional tariffs without congressional approval, should be viewed as a risk,” Maeda said.

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time