Japan’s Ruling Parties to Review ‘¥1.03 Mil. Barrier’; Opposition DPFP Wants to Raise Income Tax Threshold

Democratic Party For the People leader Yuichiro Tamaki

15:11 JST, November 6, 2024

The government and ruling parties have agreed to review the so-called ¥1.03 million barrier, or the income threshold above which people must pay income tax, a move advocated by the Democratic Party for the People, according to sources within the government and ruling parties.

With the coalition government of the Liberal Democratic Party and Komeito having been reduced to a minority in the House of Representatives after the recent election, those two parties have decided that it is inevitable to adopt some of the DPFP’s policies for the smooth operation of the Diet. Since the DPFP’s proposal is expected to result in a major reduction in tax revenues, the government hopes to reach a consensus with the DPFP on revising the proposal.

The DPFP places the highest priority on reviewing the current income tax system. Currently, there is a basic deduction of ¥480,000 and also an employment income deduction of at least ¥550,000, depending on the amount of employment income. This means tax is imposed only on incomes exceeding the total of those two figures, which is ¥1.03 million. The DPFP insists on raising this threshold to ¥1.78 million.

As the ¥1.03 million threshold is said to be a psychological barrier that discourages part-time workers from increasing their income by working more, the government and ruling parties will consider a review of this issue. Stimulating consumption by increasing take-home pay will help revitalize the economy, and an increase in working hours will also help alleviate the labor shortage.

A future issue is the huge tax revenue loss that is expected if the tax exemption is raised to ¥1.78 million. Given the government’s estimate of a ¥7 trillion to ¥8 trillion loss in revenue for the national and local governments, the government and ruling parties plan to discuss with the DPFP whether it is possible to minimize the size of the exemption increase so as to limit the loss in tax revenues.

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

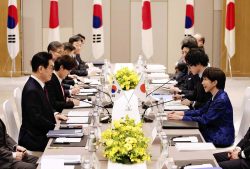

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time