Supplies of the sedative propofol, foreground, were short at Osaka University Hospital’s Department of Pharmacy during the fourth wave of novel coronavirus infections.

14:26 JST, February 25, 2022

This is the third installment in a series that explores Japan’s vulnerabilities in areas including the protection of vital information and supply networks, prompting the Japanese government to expedite efforts to pass an “economic security promotion law.”

During the fourth wave of novel coronavirus infections that started last spring, many medical institutions suddenly faced a perplexing situation.

“We were driven into a corner and were about to refuse to accept new patients,” said Tomoya Yamamoto, vice director of the Osaka University Hospital’s Department of Pharmacy in Suita, Osaka Prefecture.

At the time, the hospital was a core medical institution designated to cope with COVID-19 patients in Osaka.

What was causing the difficult situation was a shortage of propofol, a sedative used on seriously ill patients who need mechanical ventilators.

According to major drug distributor Maruishi Pharmaceutical Co., the shortage occurred because the supply made by German health care products company B. Braun could not catch up to the demand amid the global pandemic.

The hospital allocated all 30 intensive care units exclusively for COVID-19 patients and just managed to treat the patients, using various means including administering other kinds of sedatives.

Based on the lessons from the fourth wave, propofol shortages have not occurred at the hospital during the fifth and sixth waves of the infection.

“During the fourth wave, we were walking a tightrope, with medicine transported to the ICUs immediately upon arrival,” Yamamoto said. “Even if demand is concentrated on a single drug, it is necessary to build a system to prevent negative impacts on medical services.”

In 2019, there was a tie-up in the distribution of cefazolin, an antibiotic used to prevent infections especially during surgery.

The trouble stemmed from a materials production base in China in autumn 2018, with foreign matter also found in a plant in Italy that manufactured the active pharmaceutical ingredients. Supplies resumed in autumn 2019.

The incident had a large impact on medical facilities as they had to postpone many surgeries.

China’s large presence

Japan’s supply chain for pharmaceuticals and active pharmaceutical ingredients is largely reliant on other countries.

The value of Japan’s domestic production of pharmaceuticals for use in medical facilities was about ¥8.5 trillion in 2020, but nearly 70% of this, or about ¥5.9 trillion, was due to the majority of the main ingredients being imported, according to a survey by the Health, Labor and Welfare Ministry.

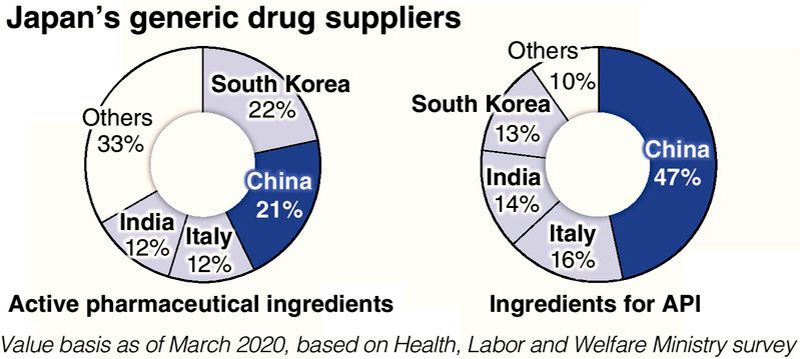

Looking at suppliers of active pharmaceutical ingredients for generic medicines in Japan, those of South Korea and China each accounted for more than 20% on a value basis. When it comes to the origin of materials to make the active pharmaceutical ingredients, China accounted for nearly half, followed by Italy and India.

“In many cases, when we look into the origin of materials, we arrive at China,” said Ichiro Fujikawa, chairman of the Japan Pharmaceutical Traders’ Association. “Japan has been increasingly relying on China for medicine.”

China has been raising its presence as the world’s pharmaceutical factory. According to China’s Industry and Information Technology Ministry, the nation’s production and export of items such as active pharmaceutical ingredients, antibiotics, antipyretics, analgesics and vitamins are on the largest scale in the world.

The administration of Chinese President Xi Jinping compiled in May 2015 an economic development plan called “Made in China 2025” that lists biopharmaceuticals and advanced medical products as a strategic priority sector just like new materials and new-energy vehicles.

COVID-19 vaccines have already become an important diplomatic card to play. Just last year, the country exported 2 billion doses of vaccine, mainly to developing countries, according to China’s Commerce Ministry.

China’s next target is development of oral medicines to treat COVID-19 patients.

Chinese Vice Premier Sun Chunlan, who is in charge of infection prevention measures, instructed officials in October 2021 to make utmost efforts to develop treatment medication and show achievements as soon as possible.

A senior Japan health ministry official said with alarm, “In the future, it is very possible that we will become aware that pharmaceuticals necessary in outbreaks of new infectious diseases have been produced in China when such pharmaceuticals will be actually needed.”

Costly responses

The Japanese government’s response has just gotten underway. The 2019 shortage of cefazolin led the health ministry in March 2021 to designate 506 ingredients for pharmaceuticals as drugs that should be secured. The designation was made considering how fragile supply chains are and the seriousness of diseases these drugs target.

The ministry divided them into three categories in accordance with the priority. At the top is category A and comprises 21 ingredients, including propofol and cefazolin.

In June 2020, the government started a project to partly assist capital investments for domestically producing the active pharmaceutical ingredients and raw materials that have a high reliance on other nations.

In an open bidding for the purpose, five business plans, including one by a group firm of Shionogi & Co., were chosen, and the firms have been enhancing their domestic manufacturing capabilities.

If a bill for the promotion of economic security is passed, the government plans to specially designate highly important drugs. Once designated, the government would request companies to diversify the producers and sellers of the pharmaceuticals and to keep inventory. The government would also provide aid such as special loans for the purpose.

There is the fear, however, that rises in purchasing and labor costs due to the possible new measure would be tacked onto drug prices, thus increasing the medical fee burden on the public.

“The public must understand that having a stable supply of drugs is costly,” said Prof. Hiroyuki Sakamaki of Kanagawa University of Human Services, an expert on pharmaceutical policy. “The government and pharmaceutical companies should collaborate with Western nations to resolve the common concern about reliance on China for pharmaceuticals.”

Top Articles in Politics

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Sanae Takaichi Elected Prime Minister of Japan; Keeps All Cabinet Appointees from Previous Term

-

Japan’s Govt to Submit Road Map for Growth Strategy in March, PM Takaichi to Announce in Upcoming Policy Speech

-

LDP Wins Historic Landslide Victory

-

LDP Wins Landslide Victory, Secures Single-party Majority; Ruling Coalition with JIP Poised to Secure Over 300 seats (UPDATE 1)

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan