Japan Tries to Catch up with China in Tug-of-War over Copper, Cobalt, Other Important Minerals in Africa

Kabanda Ilunga digs for copper ore beside a road in Kolwezi, the Democratic Republic of the Congo, on Aug. 6.

12:53 JST, August 21, 2025

KOLWEZI, Democratic Republic of the Congo — Japan has fallen behind in the race to form cooperative ties with African countries for access to their mineral resources, and the country is now trying to make up lost ground, as the mineral-rich continent is becoming increasingly important for Japan’s economic security.

China, in contrast, has gained control over many African supply chains of key minerals essential for advanced technologies and for which demand has been rapidly increasing.

The Japanese government aimed to strengthen ties with African nations by holding the Ninth Tokyo International Conference on African Development (TICAD 9) in Yokohama from Wednesday to Friday.

Copperbelt

In Kolwezi in the south of the Democratic Republic of the Congo (DRC), Kabanda Ilunga, 45, crumbled soil on the ground beside a paved road. From the pile that formed, he picked up a bean-sized piece of copper ore.

“High grade [copper] is 35,000 [Congolese] francs (about ¥1,780) per kilo,” he said. “[Chinese people] buy all of [it].”

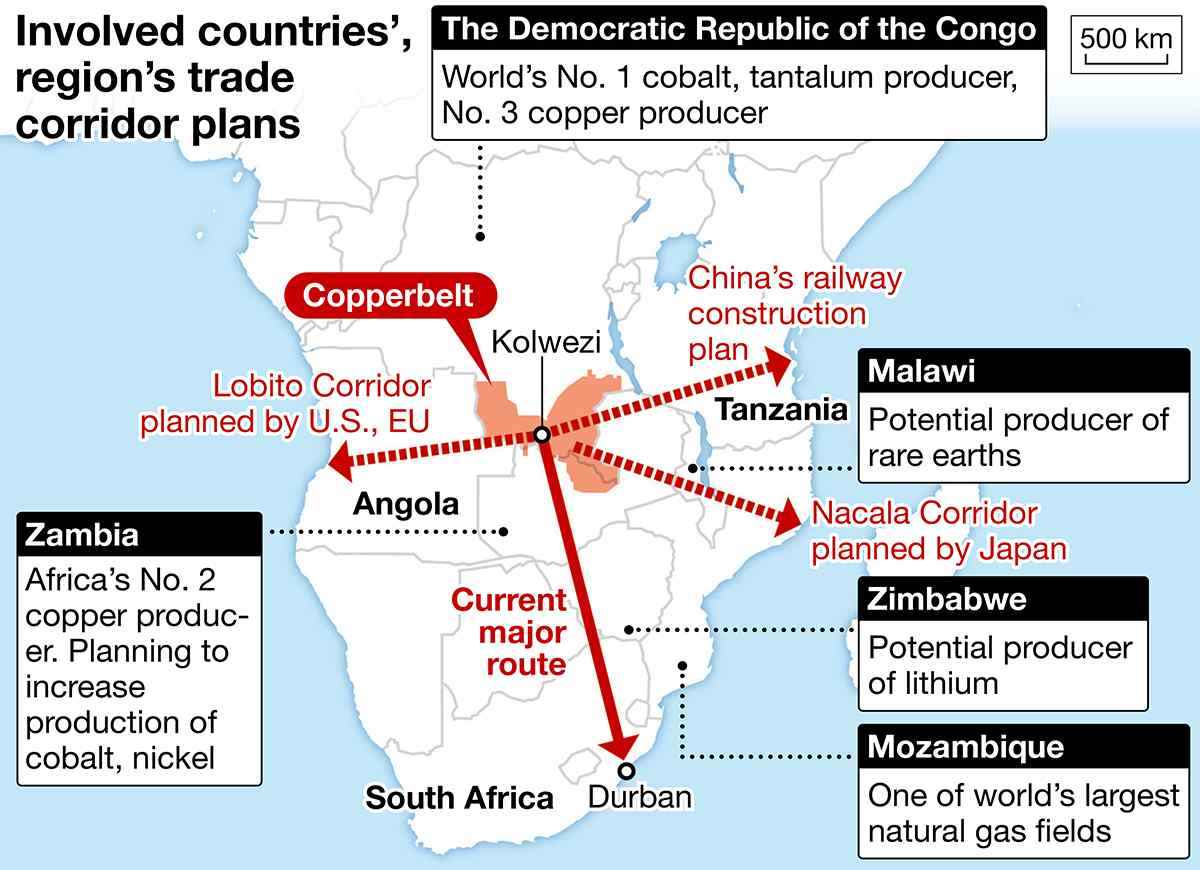

Kolwezi is located at the center of the Copperbelt, one of the largest copper deposits in the world, which extends from the south of the DRC to the north of neighboring Zambia.

In addition to copper, the area also contains a large amount of cobalt, which is used in electric vehicle and smartphone manufacturing.

Chinese buyers even have a dominant presence in transactions involving minerals mined by private individuals on lands beyond those owned by mining companies.

European countries, which once colonized Africa, and the United States had had strong ties with countries on the continent for many years. However, in the wake of the Cold War, the international community largely moved its focus away from Africa, and Western investment in the continent stagnated due mainly to human rights concerns and bribery. Japanese companies are also deeply cautious about investing in African countries.

China, on the other hand, has made huge investments in roads, electric power plants and other infrastructure since the 2000s, aiming to secure natural resources and foster friendly public opinion toward China.

Competition intensifying

According to a report by International Energy Agency this year, copper production in Africa accounts for 17% of the global total, while its cobalt production accounts for about 70% and its lithium production 11%.

Demand for cobalt and lithium is predicted to continue its rapid growth, increasing 6.4-fold and 12.8-fold respectively in 2040 from 2020 levels.

Investment in mining industries in regions from the Middle East to Africa is on the rise, and competition for minerals has never been fiercer.

Chinese companies have the largest interest in mines in the DRC, which account for 67% of the total volume of global cobalt production. China smelts cobalt imported from the DRC and exports the resulting product, for which it holds a 78% share of the global market.

As a result, industrialized countries have deepened their reliance on China for important minerals, including rare earths.

The United States and the European Union in 2023 signed a memorandum with three African countries, including the DRC, on a plan to build the Lobito Corridor — a railway line connecting the Copperbelt to a port on the Atlantic Ocean — to secure export routes.

A total of $4 billion (about ¥590 billion) will be invested in the project, which will refurbish and extend a deteriorated railway. The plan aims to make transit more convenient in the mining field to facilitate a flow of people and goods.

To compete with the project, China unveiled its own plan last year to invest about $1 billion to build a railway line connecting the Copperbelt to the Indian Ocean.

Nevertheless, China’s investments into African countries have been on the decline since their peak in 2016.

Some African countries are reviewing their relationships with the Asian country due to ballooning debts. One of them is Zambia, where fewer Chinese companies are doing business than in the DRC. Zambia’s administration is trying to diversify its partners through diplomacy involving its natural resources.

Japan plans to build its own trade route, dubbed the Nacala Corridor, connecting the Copperbelt in Zambia with Mozambique via Malawi. The route will extend to the east coast of Africa, with the aim of connecting the Copperbelt to the Indian Ocean.

Currently, the main trade routes in Africa primarily go through South Africa, but Japan aims to encourage the export of copper and cobalt through the new route with an eye to streamline shipping to India, where Japanese companies have production bases.

Related Tags

Top Articles in World

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan

-

North Korea Possibly Launches Ballistic Missile

-

Chinese Embassy in Japan Reiterates Call for Chinese People to Refrain from Traveling to Japan; Call Comes in Wake of ¥400 Mil. Robbery

-

Pentagon Foresees ‘More Limited’ Role in Deterring North Korea

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged