December 5, 2021

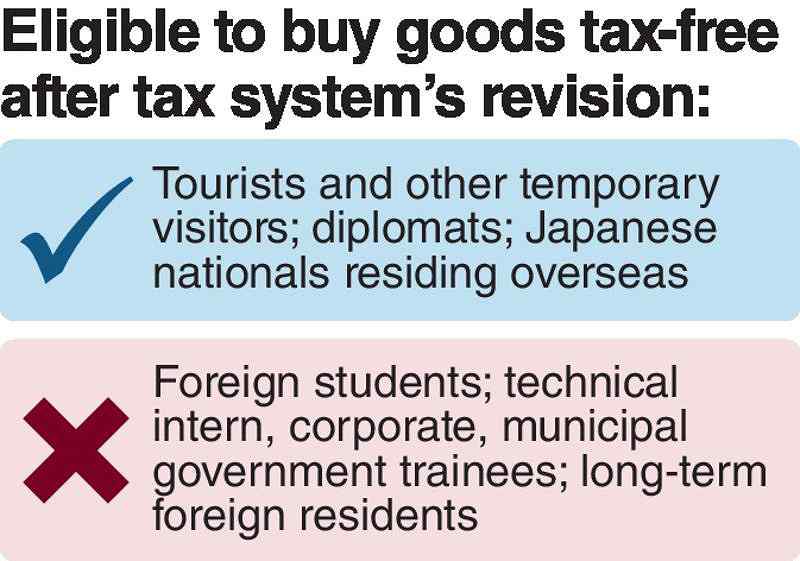

Consumption tax exemptions will no longer apply to foreign students studying in the nation after the government and ruling parties revise the taxation system for the 2022 fiscal year starting April.

Under the current law, foreign nationals intending to reside long-term who are not employed such as foreign students are eligible to buy goods tax-free for the first six months after their entry into Japan.

The revision aims to prevent these foreign residents from reselling tax-free goods for profit margins and having these goods consumed inside the nation without the proper tax being paid.

In principle, the revision will limit the scope of who is eligible to buy goods tax-free to temporary visitors in the nation for a maximum of 90 days, mainly tourists, and diplomats.

A passport reader is used as part of a system to electronically report purchases to the National Tax Agency at a tax-free counter in a shop in Tokyo.

The ruling parties will add the change to their outline of taxation system reforms.

Consumption tax is imposed on anything consumed domestically or on any assets transferred within the nation. The tax-free shopping program exempts consumption tax if goods are taken overseas.

Nationwide in May 2020, there were about 280,000 foreign students, corporate trainees and other such foreign residents who were eligible for the tax exemption program.

The revision is partly because operators of shops participating in the program have pointed out that it is overly complicated to confirm whether shoppers have jobs in Japan.

Another reason is the number of suspicious tax-free purchases by mainly foreign students. These were found after the computerization of tax-free sales procedures started in some areas in April 2020, with purchase records sent to the National Tax Agency.

According to sources, about 30,000 tax-free shops nationwide have transmitted records of about ¥40 billion worth of purchases by about 26,000 people through June this year. Of them, 1,837 bought more than ¥1 million worth of goods tax-free, with 69 of these spending over ¥100 million. More than 80% of the shoppers were Chinese nationals who were mainly foreign students.

The person who spent the most was a Chinese national who bought about 32,000 tax-free goods at a total amount exceeding ¥1.2 billion.

Cosmetics and luxury wristwatches are the usual purchases in these cases. The places of purchase were concentrated mainly at department stores in Tokyo and Osaka.

In the case of cosmetics, the amount allowed for purchase at one time is limited to ¥500,000 as the goods are consumable. But it was confirmed that a large number of foreign students repeatedly bought such items at just below the limit.

National tax authorities believe these cases to be unnatural for foreign students to repeatedly spend such high amounts to buy goods tax-free. The authorities judged it highly likely that these tax-free goods have been resold via brokers or domestic business operators.

Therefore, the Finance Ministry, which holds jurisdiction over the Consumption Tax Law, has considered a revision of the system.

Related Tags

Top Articles in Society

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Before Being Diagnosed with Disease

-

Bus Carrying 40 Passengers Catches Fire on Chuo Expressway; All Evacuate Safely

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan