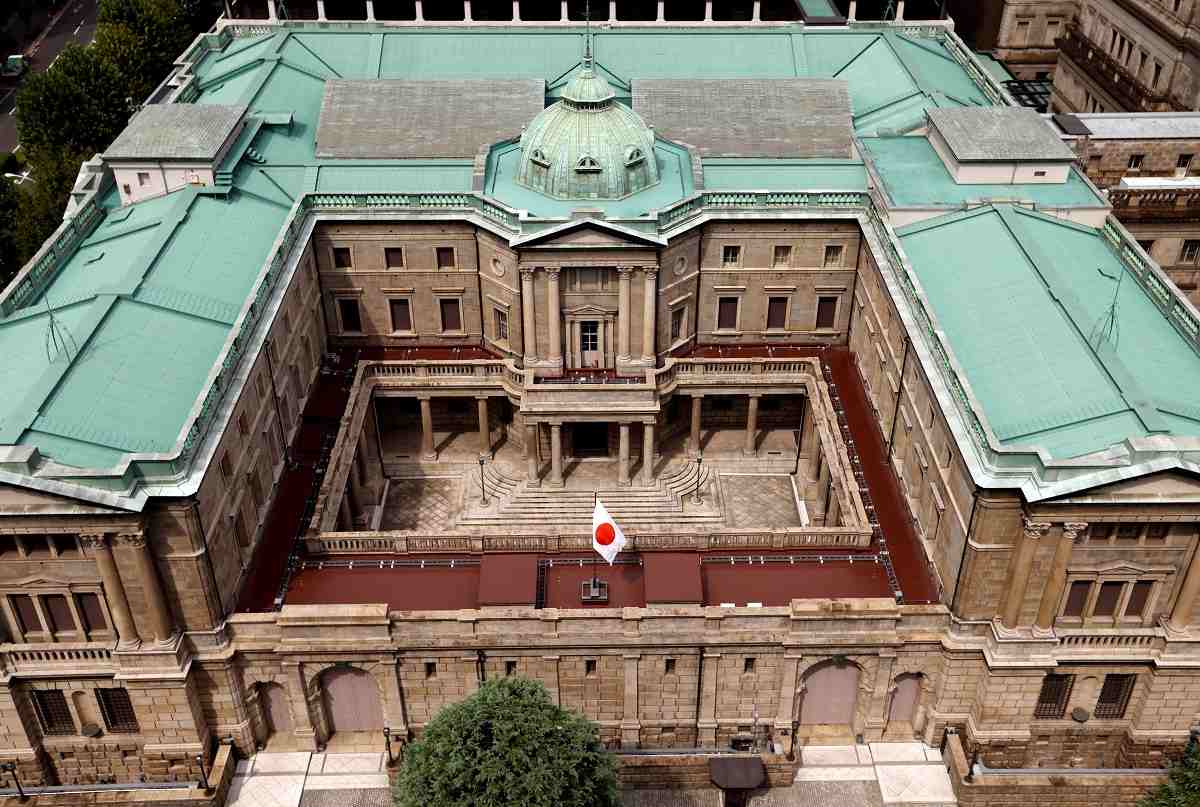

The Bank of Japan is seen in Tokyo in September 20, 2023.

15:30 JST, May 29, 2024

Tokyo (Jiji Press)—The yield on the newest issue of 10-year Japanese government bonds, regarded as the key long-term interest rate in Japan, jumped to 1.075 pct Wednesday, the highest level since December 2011.

The yield on the 0.8 pct 374th 10-year JGB issue rose for the fourth straight trading day, up 0.04 percentage point from Tuesday. The climb reflected JGB sales triggered by a surge in U.S. long-term interest rates Tuesday.

Upward pressure on the Japanese rate is increasing due to rising expectations that the Bank of Japan will reduce its JGB purchases or raise its policy rate soon.

“Unless the BOJ clarifies the pace of future reductions in its JGB purchases, (market players) cannot buy the dip even if they want to,” an official at a Japanese asset management firm said.

Meanwhile, the dollar rose versus the yen in Tokyo trading Wednesday, aided by higher U.S. interest rates.

At 3 p.m., the greenback stood at ¥157.23-23 , up from ¥156.88-88 at 5 p.m. Tuesday.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan