Japan’s Mitsubishi to Begin Procuring Gallium in Kazakhstan to Secure Rare Metal Critical for Manufacturing Semiconductors

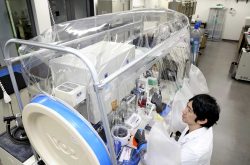

A gallium production facility is under construction in Kazakhstan.

17:26 JST, December 24, 2025

Mitsubishi Corp. is preparing to begin procuring gallium in Kazakhstan around July 2026 in an effort to secure a rare metal critical for manufacturing semiconductors and LEDs.

China dominates the market for supplying critical minerals to the tech industry.

However, as Chinese export curbs increase the risk of shortages in Japan, companies are diversifying their supply chains to ensure stability.

Mitsubishi Corporation RtM Japan Ltd., a metal resources subsidiary of Mitsubishi Corp., signed a procurement agreement with Aluminum of Kazakhstan JSC (AOK), a government-affiliated metal resources company, on Dec. 16.

Gallium is a critical mineral essential for manufacturing semiconductors, and China accounts for 96% of the world’s primary production, which excludes recycled materials.

Since China intensified its export controls in 2023, there has been a drastic decrease in gallium exports to Japan.

You may also like to read

Death Toll Rises to 10 in Taiwan Earthquake; Rescue Efforts Continue for People Stranded at Taroko GorgeJapan defines several dozen elements, including gallium, as rare metals — a broad category that also includes rare earths. Production of gallium, which is primarily extracted as a byproduct of aluminum smelting, is expected to expand in Kazakhstan, where the aluminum industry is thriving.

AOK plans to build a local facility to produce gallium as early as July, aiming to produce an annual average of about 15 tons, which is about 10% of Japan’s yearly consumption. All of the gallium produced will be exported to Japan.

Supplies are expected to go toward producing a wide range of products, including LEDs, radar systems and semiconductors for electric vehicles.

The Japan Organization for Metals and Energy Security (JOGMEC), Sojitz Corp. and U.S. aluminum giant Alcoa Corp. are also set to establish a joint venture in Australia, with gallium production scheduled to commence in 2026.

In addition to gallium, demand for other critical minerals such as lithium is surging globally, as the minerals are essential for producing semiconductors, EVs and industrial robots.

Against a backdrop of growing concerns about economic security due to China’s market dominance, major trading firms are strengthening their procurement strategies.

Mitsui & Co. invested $30 million (about ¥4.5 billion) in U.S. company Atlas Lithium Corp. to participate in lithium mine operations in Brazil.

In October, Sojitz began importing rare earths from Australia. The company aims to eventually supply around 30% of Japan’s total domestic demand.

Related Tags

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Japan’s Major Real Estate Firms Expanding Overseas Businesses to Secure Future Growth, Focusing on Europe, U.S., Asia

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

-

Green Tea Exports Hit Record High in 2025 Amid Growing Demand, Likely to Be Driving Force Behind Govt Export Target

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan