Energy Challenges / Russia’s Aggression Against Ukraine Causing Natural Gas Price Hikes Worldwide

Tanks to store liquefied natural gas are seen in Kitakyushu in July 2018.

7:00 JST, November 28, 2023

Recent events have shaken global energy markets and affected Japan, which relies on imports for most of its fuel. This is the first installment of a new series examining potential challenges for the nation’s electric power industry.

***

In August 2022, six months after Russia began its aggression against Ukraine, the price of natural gas in Europe surged to a record high of €343 per megawatt-hour.

Logged by Dutch TTF, the leading indicator of natural gas futures, the price represented a more than eight-fold increase from August 2021, when it stood at the €40 level.

The sharp hike was mainly because many European countries discontinued natural gas trading with Russia, giving rise to increased procurement of natural gases from spot markets, where trades are carried out based on short-term supply and demand.

Price trends in Europe spread to Asian markets, affecting Japan’s import costs.

In 2022, the average trading price of natural gas rose about six-fold in Japan, compared with 2019.

The market had become somewhat settled by the start of 2023 but has recently been shaken anew by the situation in the Middle East.

On Oct. 10, three days after fighting started between Israel and Islamist group Hamas, European prices surged to €52, about a 20% rise from the previous day’s closing price.

The surge was triggered by Israel’s order to halt supplies from natural gas wells inside the country in the wake of the armed conflict.

“The energy market is in the same kind of disarray as that of the first oil crisis 50 years ago,” said Takayuki Nogami, chief economist at JOGMEC, the Japan Organization for Metals and Energy Security. “There’s no light at the end of the tunnel.”

‘Miscalculation’ in Japan

Exacerbating matters, a regrettable “miscalculation” was made in Japan. JERA Co., a thermal power generation firm which is jointly capitalized by Chubu Electric Power Co. and TEPCO Fuel & Power, Inc., did not renew a long-term contract with Qatar for purchasing liquefied natural gas at the end of 2021. Until then, JERA had purchased more than 5 million tons of LNG, which accounted for one-sixth of its annual total procurements.

Though the Qatari side asked for the contract to be renewed, JERA declined to do so, based on the belief that demand for thermal electric power would decrease because the Japanese government had set a goal of cutting the nation’s emissions of greenhouse gases to net zero by 2050.

The global economy was stagnant due to the COVID-19 pandemic. A JERA source cited another reason for the decision.

“Prices in spot markets were lower than those in the long-term contract,” the source said.

But two months after the contract was terminated, Russia began its aggression against Ukraine.

Japan relies on Russia for about 10% of LNG imports. Though alternative suppliers were sought, an official of a major trading company said, “LNG was almost sold out, as China had signed long-term contracts with many countries worldwide.”

The Chinese government’s net-zero target is 2060, meaning it can make use of thermal power for a longer time than Japan.

Later, Qatar also signed a 27-year contract with a Chinese company to offset the decrease in orders from JERA.

Geopolitical vulnerability

Demand has been steadily increasing for LNG, which emits less carbon dioxide than oil and coal when burned. By some estimates, the supply-demand condition will be extremely tight around 2025.

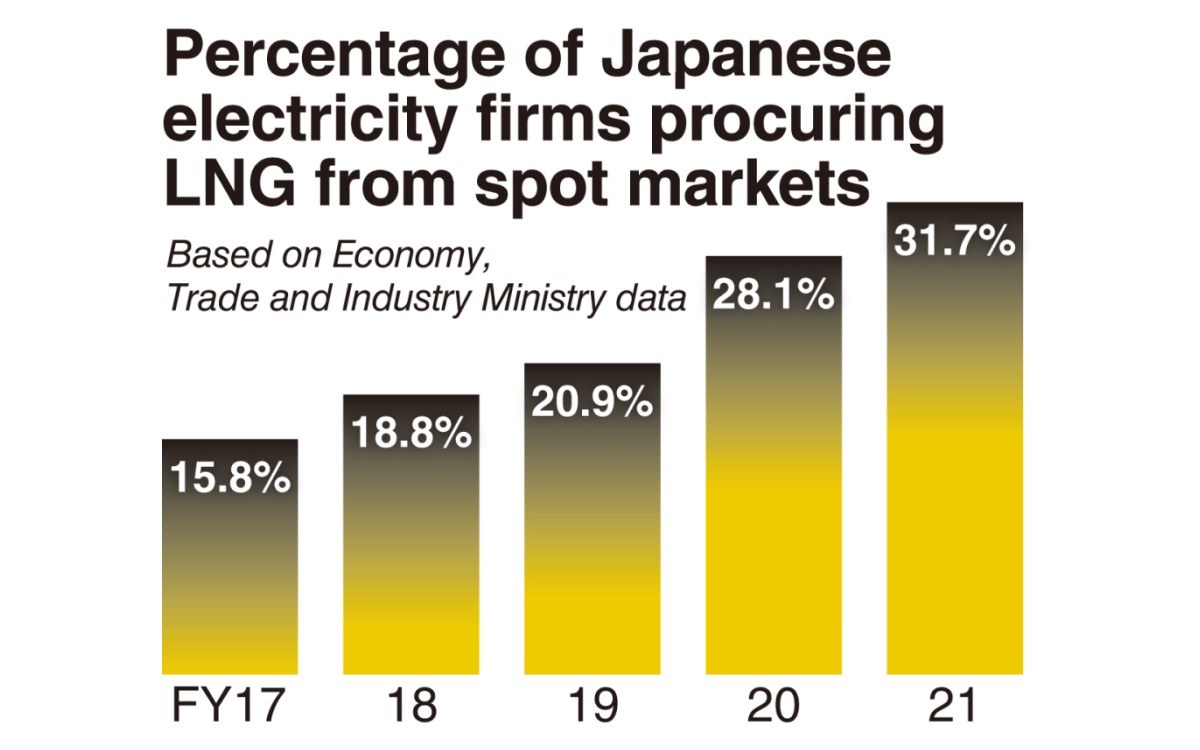

Though long-term contracts have the benefit of stable purchase prices, major Japanese electric power companies have increased procurements from spot markets in recent years, with a view toward the government’s decarbonization goal.

The percentage of procurements from spot markets in fiscal 2021 exceeded 30%, which doubled from that in fiscal 2017. Japan has thus made itself more vulnerable to negative impacts from wild fluctuations in LNG prices.

The ballooning prices will be passed on to electricity bills, meaning the burden on companies and households will be heavier.

An official of an electric power company in eastern Japan said: “Partly because of a decrease in population, it is difficult to forecast demand. We will have to continue to rely on spot markets.”

In November this year, developers and others related to the Arctic LNG 2 production project in Russia’s Arctic region were added to the U.S. government’s additional sanctions list.

Though Japanese companies including Mitsui & Co. participated in the project and planned to supply LNG to Japan, concern is rising that the plans may be obstructed.

Geopolitical risks and decarbonization goals have brought vulnerability to Japan’s electricity supply.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza