Tower condominiums under construction in Chuo Ward, Tokyo, on June 29

17:54 JST, August 13, 2024

Financial institutions have begun offering products that guarantee reducing the housing loan balance to zero if one member of a couple who took out pair loans – where both people borrow money – dies.

With the soaring sale price of properties such as newly built apartments in Tokyo, the institutions expect a constant demand for this type of product.

Mizuho Bank in July began offering pair-loan group credit insurance developed by Dai-ichi Life Insurance Co. that removes a couple’s mortgage balance if a spouse dies or is diagnosed with cancer at a medical institution after taking out pair loans.

Under group credit life insurance schemes, the balance of housing loans is covered by insurance when policyholders become unable to make mortgage payments.

The annual insurance premium of the new product is higher than conventional group credit life insurance products by 0.2%. According to Mizuho Bank, this is the first time a major bank has offered such a product.

“We believe the product will eliminate repayment concerns for people in the event their partner dies,” said Hiroshi Yui, head of Mizuho Bank’s personal loan promotion department.

A similar housing loan has already been offered by PayPay Bank, which provides financial services online and through its smartphone app. Resona Bank will also begin offering a pair-loan group credit life insurance product in October, developed by Nippon Life Insurance Co.

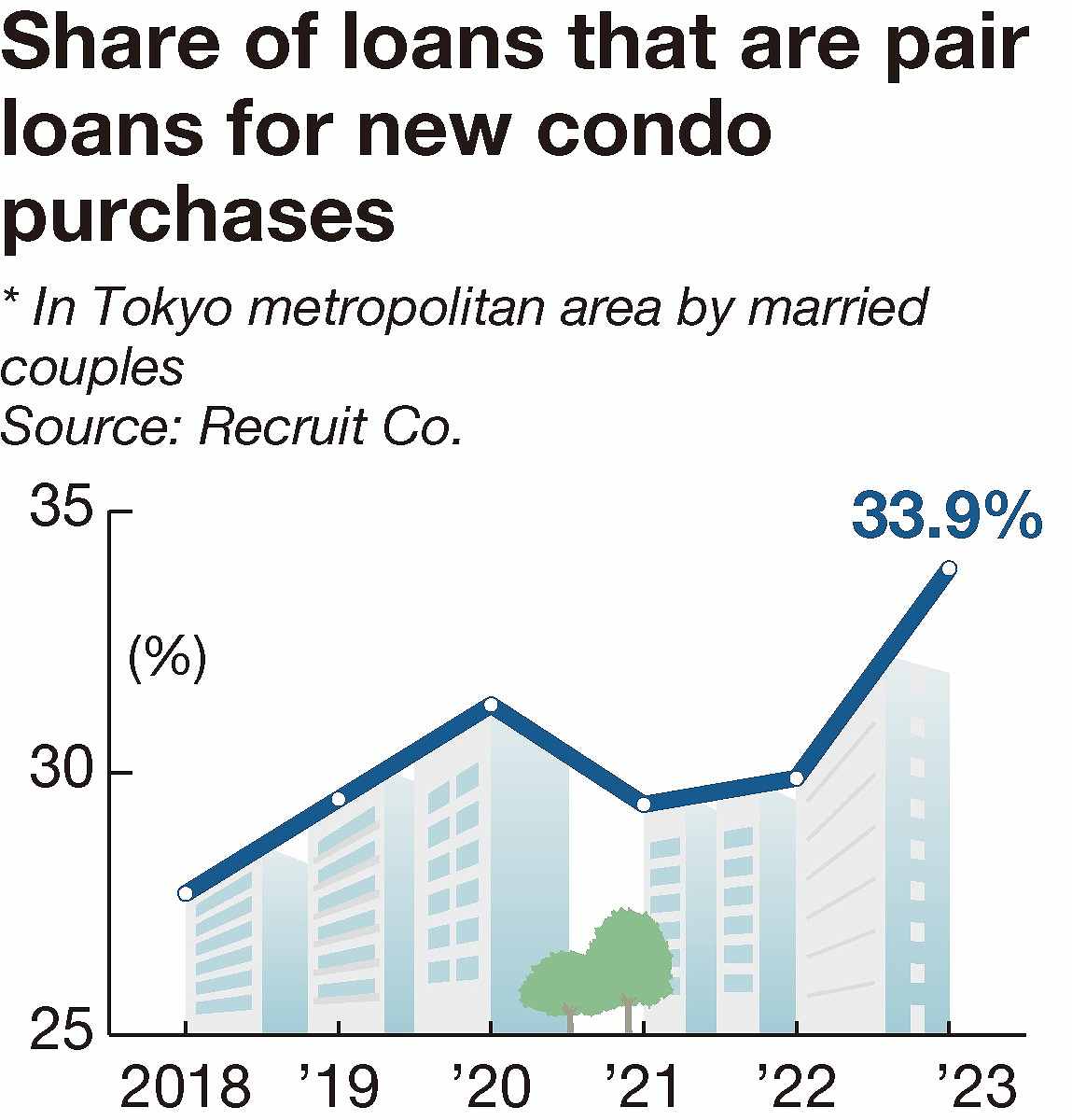

The average sale price of newly built apartments in Tokyo’s 23 wards has been hovering around ¥100 million. According to Recruit Co., 33.9% of buyers of new condominiums in the Tokyo metropolitan area took out pair loans in 2023, the highest since surveys began 2018.

Mika Kasamatsu, deputy editor-in-chief of Suumo, Recruit’s real estate and housing information website, said, “The use of pair loans will continue to increase, and more services will be provided to encourage their use.”

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan