15:00 JST, December 21, 2024

If the tax system is changed, there will be those who will benefit from it and those who will have more of a burden to bear. The role of politics is to decide on a tax system that is balanced in accordance with the ability of each individual to bear the burden.

Simply advocating large-scale tax cuts without considering the fiscal sources is nothing more than populism. The current debate over the “¥1.03 million barrier” should serve as an opportunity to consider what a fair tax burden should be.

The Liberal Democratic Party and its coalition partner Komeito have decided on the outline of the tax system reform for fiscal 2025.

The outline clearly states the policy of raising the ¥1.03 million annual income threshold for the imposition of income tax to ¥1.23 million starting in 2025. This is based on the fact that household spending on food, utilities and other expenses has increased by 20% since 1995, when the current threshold was set.

The decision to raise the tax-exemption threshold, which has been unchanged for 30 years, is understandable in the wake of prolonged high prices.

However, the outline is not the final decision.

To keep the cooperation of the opposition Democratic Party for the People, which is calling to raise the threshold to ¥1.78 million, the minority ruling bloc included the phrase, “continue to discuss in good faith,” in the outline. The secretaries general of the LDP, Komeito and the DPFP, who met in parallel with the coalition’s decision on the outline, also affirmed this stance.

The government will submit tax system-related bills, which will take the outline into account, to the ordinary Diet session to be convened in January. However, the bills might be revised depending on the discussions between the three parties.

If the maximum non-taxable income is raised to ¥1.78 million, as demanded by the DPFP, the shortfall in revenue would be between ¥7 trillion and ¥8 trillion. Even if it is raised to ¥1.23 million, as proposed by the LDP and Komeito, it would result in a tax revenue decrease of several hundred billion yen.

If the government were to rely on the easy option of issuing government bonds to make up for the shortfall without raising taxes, it would only be passing the problem on to future generations, including today’s young people. This can hardly be considered appropriate.

Meanwhile, the outline explicitly states increasing tobacco and corporate taxes from April 2026 to secure the fiscal resources needed to strengthen the nation’s defense capabilities.

Two years ago, the administration of then Prime Minister Fumio Kishida decided to increase corporate, income and tobacco taxes to raise ¥1 trillion a year to expand defense spending. The tax hikes were initially planned to be implemented from fiscal 2024, but the decision was repeatedly postponed amid growing concerns within the LDP about public backlash.

It is a step forward that a path for securing the necessary funds for increasing defense spending has been finally paved this time, although, among the three taxes, the hike on income tax will not be implemented .

There are voices within the LDP and the DPFP saying that the defense budget can be expanded without raising taxes because national tax revenue is increasing.

Just because tax revenue is slightly increasing does not mean that the country has more money to spare. Irresponsible optimism must be curbed.

(From The Yomiuri Shimbun, Dec. 21, 2024)

Top Articles in Editorial & Columns

-

40 Million Foreign Visitors to Japan: Urgent Measures Should Be Implemented to Tackle Overtourism

-

China Criticizes Sanae Takaichi, but China Itself Is to Blame for Worsening Relations with Japan

-

Withdrawal from International Organizations: U.S. Makes High-handed Move that Undermines Multilateral Cooperation

-

University of Tokyo Professor Arrested: Serious Lack of Ethical Sense, Failure of Institutional Governance

-

Defense Spending Set to Top ¥9 Trillion: Vigilant Monitoring of Western Pacific Is Needed

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

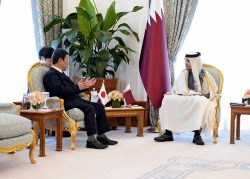

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation