Tax-Free Investment Program to be Expanded in January; Japan Seeks to Promote Shift From Savings to Investments

A seminar held by Daiwa Securities Group Inc. to explain the New NISA program on Nov. 22 in Chiyoda Ward, Tokyo

21:00 JST, December 26, 2023

The Nippon Individual Savings Account (NISA) investment program will be expanded in January by significantly increasing the maximum amount that can be invested tax-free and removing the limit on how long tax-exempt accounts can be held.

The NISA program is designed so that income from small investments is tax-exempt up to a certain point. There are strong expectations that the New NISA program will encourage investors to accumulate assets.

Interest is growing among investors, as the new program is the centerpiece of Prime Minister Fumio Kishida’s plan to double asset income.

Indefinite tax exemption

“The new program allows for tax-exemption indefinitely, so investors can build their assets by making long-term, installment saving-type, and diversified investments.” About 140 people were told this at a seminar on the new program held by Daiwa Securities Group Inc. in Tokyo late November.

The company has held 11 such seminars this year, including online events, with a maximum of more than 1,000 participants. “Public interest in the new program is very high,” a spokesperson said.

The current NISA program was launched in 2014 to encourage asset-building by individuals, and modeled after the Individual Savings Account (ISA) program in Britain. The Japan system allows investors to buy and sell stocks and investment trusts through a single dedicated account per person at a securities company, bank or other financial institution. Such investors are exempt from the usual tax of around 20% on investment gains through the account, within certain limits.

In January, an account under the new program will be automatically opened for each person who has a dedicated account under the current system. It is also possible to choose a different financial institution for the new account by following certain procedures.

Combined use possible

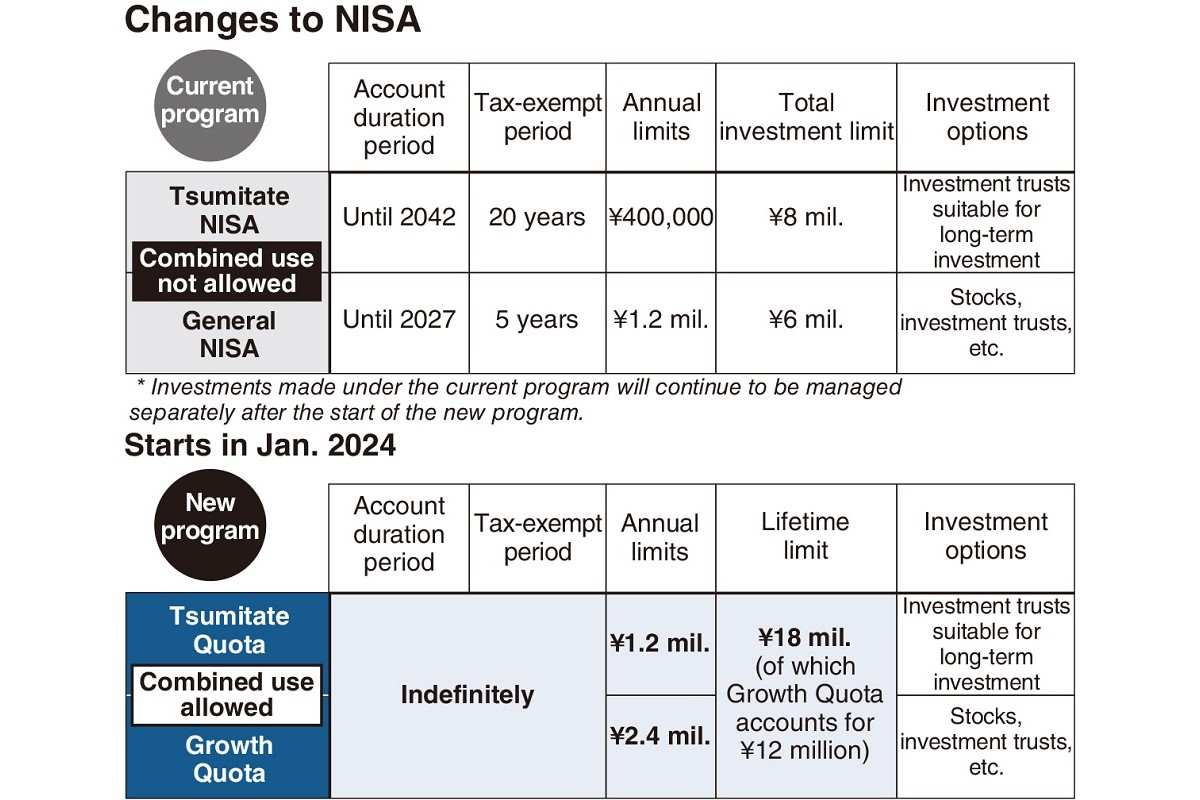

Under the current program, there are two types of NISA: the General NISA, which allows people to hold stocks and investment trusts tax-free for five years; and the Tsumitate NISA (installment saving-type NISA), which allows monthly investments in certain trusts and holding them tax-free for 20 years. Investors must choose one or the other.

The new program will allow for combined use of the Growth Quota, which corresponds to the current General NISA, and the Tsumitate Quota (installment saving-type), the counterpart of the Tsumitate NISA. In addition, there will be no limit on the tax exemption period.

The annual maximum for tax-exempt investment amounts will be doubled to ¥2.4 million for the Growth Quota and tripled to ¥1.2 million for the Tsumitate Quota. The combined upper limit on the lifetime investment amounts for the two quotas will be ¥18 million.

The Tsumitate Quota covers financial products that are investment trusts suitable for long-term investments of the installment saving-type or diversified type and meet the criteria set by the Financial Services Agency.

The Growth Quota covers investment trusts and stocks in companies listed in Japan, U.S. companies, and others.

Aimed at economic growth

The government hopes the new program will encourage individuals to shift their financial assets from savings to investments, thereby promoting economic growth. In November, the prime minister expressed his hope that the new program would “create a virtuous circle that leads to further investment and consumption.”

In Japan, more than 50% of about ¥2,100 trillion in financial assets held by households are cash and deposits. This percentage is only about 10% the level in the United States, where asset management is widespread, and about 30% of that in European countries, indicating that investment is less widespread in Japan.

Although the NISA program is aimed at stable asset building for individuals, losses could result from the selling price falling below the investment amount.

Financial education is also becoming increasingly important. Next spring, the government will establish an authorized corporation for promoting economic education, to better provide information to the public.

“It is important to know the basics of investment, such as the use of surplus funds, and recognize that they will earn profits in the long term,” Yusuke Maeyama of the NLI Research Institute said.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan