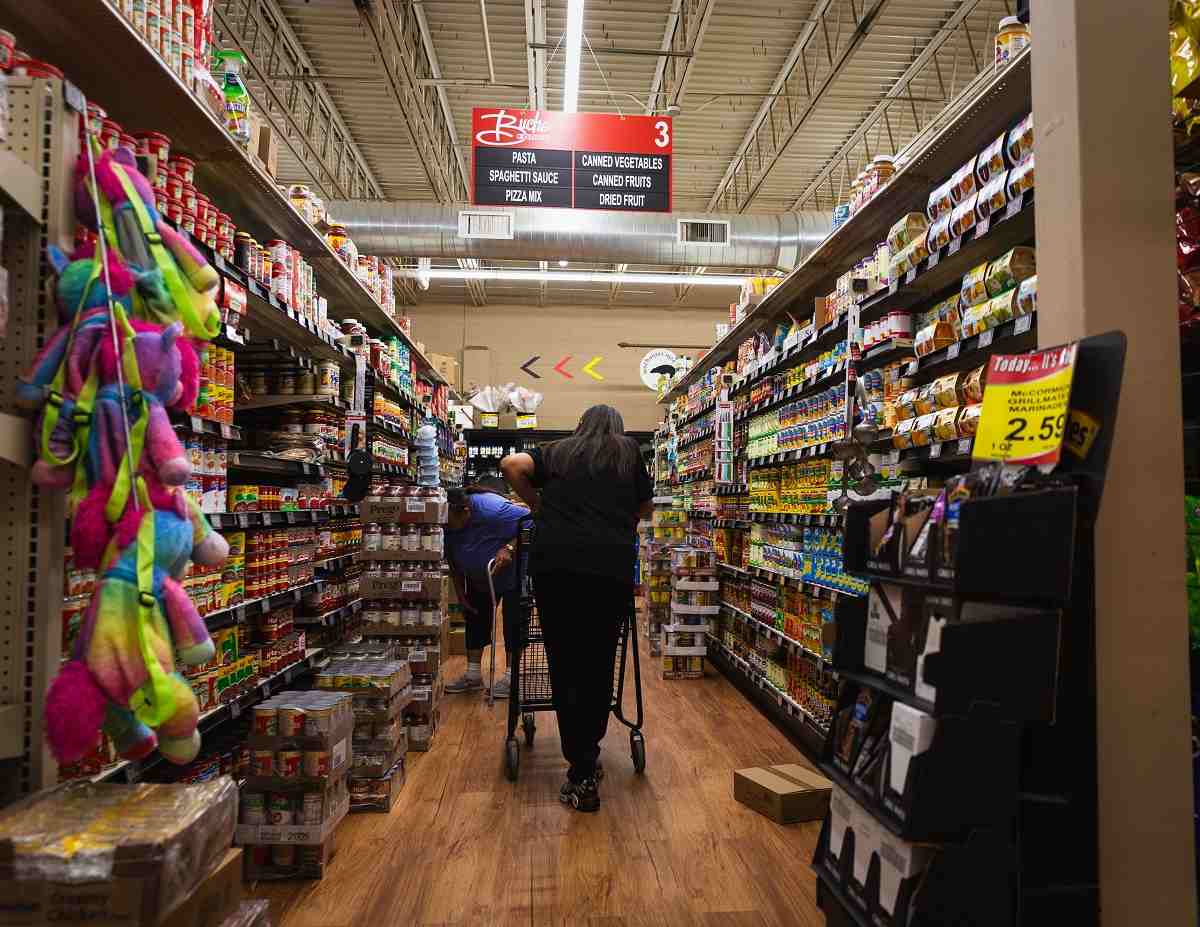

Buche Foods is the only full-service supermarket in Pine Ridge.

Independent grocers like Buche Foods are facing unprecedented challenges in the face of competition, industry consolidation and thinning margins.

16:06 JST, August 27, 2024

PINE RIDGE, S.D. – RF Buche, whose family has been running grocery stores in South Dakota since 1905, hears the complaints and can hardly disagree: Yes, prices are too high. But no, he insists, he isn’t ripping anyone off.

But many of his customers have a tough time reconciling how the head of Buche Foods – the only full-service supermarket on the Pine Ridge Indian Reservation, a stretch of plains larger than the state of Delaware – might not have the final say on store prices.

Buche says he understands the frustration but has little room to maneuver. Like other retailers, he’s had to contend with inflation, supply chain disruptions, consolidation and other fallouts of the pandemic. But as an independent grocer, his seven-store chain doesn’t have the purchasing power of a Walmart, Costco or Kroger to leverage wholesalers on price or priority. That’s why his shoppers can see a price differential of 20 percent to 100 percent on everything from potatoes to diapers.

“We have to defend ourselves against accusations of price-gouging and that really, really stings,” said Buche (pronounced BOO-ey), scanning the produce aisle as most shopping carts trundled by with one or more loaves of sliced white bread on sale that week, marked down 50 percent.

Grocery prices – which have jumped about 21 percent since July 2020 – have spurred finger-pointing in every direction: retailers, suppliers, policymakers. As a proxy for many people’s view of the economy, food costs stand to play prominently in the November election, and in three court cases attempting to block the $24.6 billion merger of grocery giants Kroger and Albertsons. The first, launched by the Federal Trade Commission, eight states and the District of Columbia, begins Monday.

But independent grocers, routinely the only option for fresh food in poor rural and urban communities, are especially vulnerable in this climate. Though there is no national database for such stores, a dozen business owners and experts who spoke to The Washington Post say their risks have been compounded by the rapid expansion of dollar stores, growing power of big-box retailers and rise of dynamic pricing. Buche, for his part, has had to shutter three stores in the state in six years.

“I’ve gone through a divorce,” he said, “but having to close a store – it’s worse.”

But independent grocers can have an outsized effect on the communities they serve: They anchor neighborhoods and sponsor sports teams, host cookie drives and community events, and raise money for families in need. When one goes under, experts say, the conditions are ripe for food deserts to develop.

Oglala Sioux Tribe President Frank Star Comes Out, right, says RF Buche and Buche Foods are responsive to the community’s needs.

At Pine Ridge, which includes 32,000 members of the Oglala Sioux Tribe, Buche Foods caters to a region where unemployment hovers near 80 percent and more than half of the residents live below the federal poverty line, according to tribal leaders. Residents don’t have easy access to national retail chains – even Walmart, the nation’s largest food seller by far – requires a 55-mile drive to Chadron, Neb. But because only a fraction of the population owns a vehicle, most wind up paying someone for a ride to the superstore. The going rate is $25.

“Some of the most vulnerable communities in this country don’t have access to fair prices,” said FTC Commissioner Alvaro Bedoya, who has twice visited Pine Ridge after discovering Buche’s 2021 testimony as part of a roundtable on food insecurity in rural America before the House Rules Committee. The independent grocers who serve them “don’t have a level playing field.”

Prices take off

The run-up in grocery prices took root in 2020, early in the pandemic, amid a mix of supply chain bottlenecks and labor shortages, and later exacerbated by the war in Ukraine. Inventory scarcity was common even for big chains, but it was a particularly tough time for Buche, who said a baby formula shortage had him putting in 1,10o miles a week crisscrossing the state redistributing inventory from one store to another based on local need. Clorox wipes and children’s Tylenol were also hard to keep in stock, and he sometimes resorted to buying from Walmart and Costco to resell at a slim margin.

“I can’t tack that onto the price of goods,” he said, referring to the added labor and fuel costs he absorbed to redistribute merchandise. “It’s not right.”

But even as supply chain logjams eased, prices didn’t fall in tandem. In 2023, 11.2 percent of consumers’ disposable income went to groceries, according to USDA data, compared with 8.6 percent in 2020.

Many consumers and policymakers blame retailers for the run-up, with the latter alleging they used coercive tactics like price fixing and price gouging, and leveraged technology and data collection to keep prices artificially high. Vice President Kamala Harris made it a core issue in her presidential campaign this month, calling for a ban on price gouging in the food and grocery sectors. And lawmakers like Sens. Elizabeth Warren (D-Mass.) and Bob Casey (D-Pa.) have set their sights on electronic price tags being rolled out by Walmart and Kroger. Warren and Casey contend that the tags would allow for surge pricing based on demand.

But small and regional retailers have proportionally higher upfront costs than their big-chain rivals, and it shows in their margins. Privately owned grocers reported a net profit before tax of 1.4 percent last year, down from 5 percent in 2020, according to research from the National Grocers Association. In the first three quarters of 2023, net profit margins for big-box and supermarket chains stood at 7 percent, according to an FTC study. Since the pandemic, the major chains have been operating at the highest profit margins on groceries in two decades, the White House Council of Economic Advisers said earlier this year.

Meanwhile, independents can’t secure the same volume discounts as their big competitors, and stores in remote areas have heftier costs because delivery requires more fuel and staff hours. Buche says he generally pays suppliers 20 to 40 percent more than he did five years ago, depending on the item. For example, a 24-pack of ramen went from $5.22 in 2019 to $7.63 in 2024, up 46 percent; and a case of Malt-O-Meal cereal jumped 28 percent to $35.41.

Industry experts, federal regulators, think tanks and lawmakers contend that strategies employed by large retailers like Walmart, Kroger, Target and Amazon during the pandemic spurred not just higher prices in their own stores, but exponentially for small and regional grocers. (Amazon founder Jeff Bezos owns The Post.)

Chris Jones, chief government relations officer and counsel at the National Grocers Association, said the current system is “unsustainable” for independent grocers: “If the status quo continues, many more independents will shut their doors or sell off to larger chains.”

Big-box stores and grocery giants leverage their size and influence to dictate the price they pay suppliers, according to an FTC study. In turn, wholesalers and producers charged independent grocers more to make up the difference, Bedoya said.

Consolidation has also beefed up retailers’ negotiating power, Bedoya said. Grocery store numbers fell 30 percent from 1994 to 2019, according to an analysis by the nonprofit Food and Water Watch. By 2023, just three corporations – Walmart, Kroger and Costco – generated more half of the $1 trillion in U.S. grocery sales. Walmart alone accounted for one-third.

Walmart did not respond to The Post’s multiple requests for comment.

The FTC cites such market dynamics in its bid to block the Kroger-Albertsons union on antitrust grounds, warning that allowing two of the nation’s largest grocery chains to merge would eliminate competition, raise prices and hurt workers. The case gets underway Monday in U.S. District Court in Portland. The states of Washington and Colorado have mounted separate legal challenges; both trials begin next month.

On Monday, in what legal experts characterized as an extraordinary attempt to interrupt the regulator’s enforcement powers, Kroger sued the FTC to end a separate review of the deal in administrative court.

In statements to The Post, the companies said the merger would benefit consumers: “Kroger’s business model is built on a foundation of bringing customers lower prices and more choices,” a spokesperson said. The company said it is investing $1 billion to lower prices and announced plans to divest 579 stores in a deal with C&S Wholesale Grocers.

Jordan White, a third-generation grocer with eight stores in rural Kansas, already feels at a competitive disadvantage to the likes of Kroger and Walmart when it comes to prices from vendors like Coke and Pepsi. “They’re always advertising prices cheaper than we’re buying it for,” White said.

The FTC says independent grocers have higher prices because of suppliers’ price discrimination, which has been illegal under antitrust law since 1936, when Congress passed the Robinson-Patman Act. Enforcement fell away decades ago as regulators shifted to more “efficiency-oriented, consumer-oriented antitrust,” said Seattle University law professor John B. Kirkwood.

Bedoya and FTC chair Lina Khan have signaled their intention to resurrect the law. The consequences of it laying dormant for decades means that folks like those in Pine Ridge are the ones “that pay the highest prices for nonenforcement,” Bedoya said.

Cheaper competitors

Buche Foods gives Pine Ridge seniors $20 grocery gift cards on the last Wednesday of each month – for many people, it serves as a bridge until their next SNAP benefits arrive. When Pauline Brouillard, 69, claimed one in May, she picked up some sliced bread and sausages, and treated herself to a 12-pack of generic root beer and a bag of Flamin’ Hot Funyuns.

“I get what I can,” she said. “The prices are too high here.”

When cost is the bottom-line consideration, shoppers often stock up on food that is “not healthy and they know it’s unhealthy,” said Frank Star Comes Out, the president of the Oglala Sioux Tribe. “But they also know it will cover a few days and prolong their meals.”

Fresh fruit and vegetables cost more and have shorter shelf lives than processed foods, Buche noted. “If you got 10 bucks, the first words out of your mouth aren’t ‘a head of lettuce.’ It’s ‘frozen pizza’ or ‘five boxes of mac and cheese.’”

Two miles south of his store, just across the Nebraska border in White Clay, are two of his prime competitors: Dollar General and Family Dollar. Though Buche says their selection and service are no match for his 20,000-square-foot store, he feels as though he’s constantly looking over his shoulder: “Across the country, I am seeing a lot of rural grocery stores go under because of these Dollar Generals.”

Dollar stores have “really taken hold” in rural communities,” says Rial Carver of the Rural Grocery Initiative at Kansas State University, and many independents view them as a bigger threat than a megaretailer like Walmart.

Though Dollar General said it is offering fresh produce in about a quarter of its stores, the one near Pine Ridge carries only packaged and frozen foods.

“They’re selling a size that is probably 75 percent the size of what we are selling,” Buche said. “But to a consumer, they firmly believe … [it] is the same size as what I’m carrying at my grocery store when it’s not.”

In a 2021 survey conducted by the Rural Grocery Initiative at Kansas State University, rural grocery stores cited discount retailers as a greater threat than supercenters like Walmart. Dollar stores have “quickly entered rural America and really taken hold in communities,” said Rial Carver, program leader at the institute.

Bryan Sims, who owned a store in Elizabeth, W.Va., said he shut it down partly because of the prices at Dollar General. White, the Kansas business owner, said he has trained his children to say “Dollar General is the ruination of rural America,” whenever they drive past one.

“We believe the addition of each new store provides positive economic benefits,” Dollar General said in a statement to The Post, including affordable products, jobs tax revenue and nonprofit grants.

A community anchor and lifeline

Victoria Shoulders, 46, didn’t have to worry about affording to feed her family while she underwent cancer treatment last year. That’s because Buche took care of her groceries.

He also donates groceries to dialysis patients once a month, gives away 10-pound tubes of ground beef to veterans on the last Wednesday of the month, stays open late when SNAP benefits are dispersed, donates food to tribal gatherings and to Missing and Murdered Indigenous Women meetings, and helps support local sports teams.

“What he’s doing is a godsend to the tribe,” Shoulders said.

White, of Kansas, said his business donates to school functions, allows the Girl Scouts to sell cookies outside his stores, hosts community events and donates to local food banks. “We are heavily involved in the communities we’re in,” he said. “Dollar General won’t do that.”

In a statement, a Dollar General spokesperson said the chain has donated more than $298 million to local communities and that in 2023, it “supported more than 3,000 communities through our nationwide partnership with Feeding America.”

Independent stores also create local jobs, said Carver, of the Rural Grocer Institute. Of the 60 people Buche employs at his Pine Ridge store, only three are nonnative. “That’s huge,” said tribe president Star Comes Out.

Juanita Scherich says she likes to shop at Buche Foods because the store staff has “really bonded, it’s like a family.

It’s one of the reasons Juanita Scherich chose to do her grocery shopping at Buche Foods, even though it’s about 50 miles south of her home in Kyle. “The people that work here are really bonded, it’s like a family,” the 65-year-old told The Post, shortly before her death in July.

Star Comes Out fears what could happen if the store were to close. Often when poor rural and urban communities lose an independent grocery store, it can cause ripple effects in their local economies, Carver said.

“We have barriers in every direction we look, and food is only one of them,” Star Comes Out said, noting the reservation’s crumbling infrastructure and how some residents live without electricity or running water.

“I thank RF for being patient enough to work with the tribe. It takes a lot and he did a good job taking on the needs of our tribe. ”

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza