Broken Talks: Honda & Nissan / Mitsubishi Motors’ PHVs, Presence in S.E. Asia Raised Honda’s Expectations

Mitsubishi Motors Co. President Takao Kato responds to questions from the press in Tokyo on Thursday.

2:00 JST, February 18, 2025

This is the third and final article in a series examining the failed management integration talks between Honda Motor Co. and Nissan Motor Co.

***

At January’s gathering of the Mitsubishi Kinyokai, a body comprising presidents of companies with roots in the now-defunct Mitsubishi zaibatsu conglomerate, Mitsubishi Motors Corp. President Takao Kato was at the center of proceedings.

“How was that press conference?” one of the members asked Kato, referring to the one held on Dec. 23, where Honda and Nissan announced that they had entered into discussions on a possible business integration. Kato had joined Honda President Toshihiro Mibe and Nissan President Makoto Uchida on stage. Mitsubishi Motors had also announced that it would consider joining the merger.

During the hourlong press conference, Kato spoke for just under four minutes.

“To be honest, I didn’t want to attend,” Kato said.

From the start of the year, Mitsubishi Motors had been leaning toward not joining, and Honda and Nissan’s talks ultimately reached an impasse.

With Nissan’s restructuring plan showing few signs of progress, it was not seen as a good idea for Mitsubishi Motors’ management to be constrained. The decisions by Mitsubishi Motors also took into account the Mitsubishi Group, including Mitsubishi Heavy Industries, Ltd., a shareholder.

Despite Kato’s reluctance, Honda had high hopes for Mitsubishi Motors. While Honda’s primary market is the United States, Mitsubishi Motors has a strong presence in Southeast Asia and has more technical expertise than Honda regarding plug-in hybrid vehicles (PHVs), which are seen as a bridging technology until electric vehicles (EVs) become more widely used.

To encourage Mitsubishi Motors, Honda is said to have sought investment from Mitsubishi Group companies in the envisioned joint holding company. There is even a view that Honda’s main target was actually Mitsubishi Motors.

When announcing the company’s financial results at a press conference on Feb. 3, Kato was asked about the progress in the negotiations. He replied, “I think it will involve some difficult decisions.” The comments appeared to hint at the talks falling through 10 days before the official decision.

Honda and Nissan on Thursday announced that they had withdrawn from business integration negotiations. Kato spoke to media in Tokyo that night, saying, “We will move forward so that we can quickly see the benefits of our collaboration [within the framework of a strategic partnership.]”

The three companies are still planning to move ahead with a partnership on EVs and other products, which was announced in August, but its effectiveness is in doubt. Honda’s Mibe has admitted that “the synergistic effect is less than that of a merger.”

Struggles in key market

Mitsubishi Motors earlier this month lowered its consolidated earnings forecast for the fiscal year ending March 2025 by ¥109 billion. It now expects a net profit of ¥35 billion, down 77% year-on-year. The slow economic recovery in Thailand and Indonesia is said to be the main reason, but the expansion of Chinese companies in Southeast Asia — which is the stronghold of the Japanese automaker — with their cheap EVs is also having an impact.

Impeded by tariffs in Europe and the United States, China has instead turned its eyes southward. According to the Japan External Trade Organization (JETRO), China exported 1.54 million EVs in 2023, a 60% increase from the previous year. Its exports to Thailand, Mitsubishi Motors’ main market, doubled to about 150,000. Exports to the Philippines rose 70% to 110,000. Japanese automakers once boasted a 90% share of the Thai market, but this has now fallen to less than 80%.

Chinese automakers are also accelerating the development of local production bases. It is not easy to keep up with the onslaught. Kato said, “The situation is severe, and it is difficult to see what the future holds.”

Comparable quality

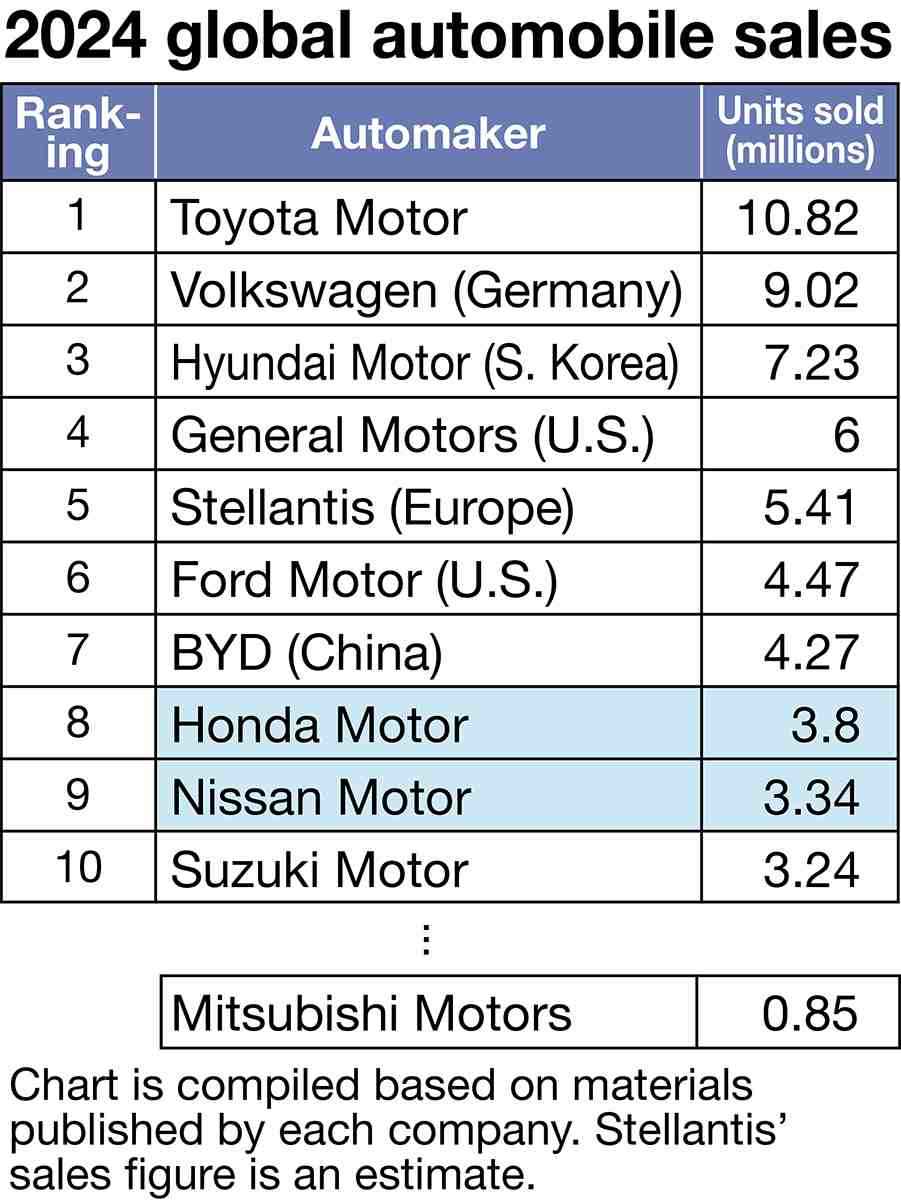

If the business integration of Honda, Nissan and Mitsubishi Motors were realized, it would have created the world’s third largest automaker, after Toyota Motor Corp. and Volkswagen AG, and domestic automakers would have been split into two groups. While the domestic reorganization is dragging on, the global situation is changing rapidly.

Chinese state-owned major automakers Chongqing Changan Automobile Co. and Dongfeng Motor Corp. were reported earlier this month to be planning a reorganization. If realized, it would create a major force with annual sales of over 5 million units. It would also surpass China’s BYD Co., which sold 4.27 million vehicles worldwide in 2024 to overtake both Honda and Nissan for the first time.

Chinese companies are also making inroads in Japan. BYD in January announced that it would sell its PHVs in Japan for the first time in 2025. Although it has not announced prices or models, it sells some in the ¥2 million range in China – more than ¥1 million less than the models Mitsubishi Motors is selling in Japan.

“The quality is on par with our own models, and they are a far greater threat than EVs,” an executive at a major Japanese automaker said. “The days of cheap Chinese-made cars being of poor quality are over.”

Seismic shift becomes evident

U.S. President Donald Trump announced Friday his intention to impose tariffs on cars imported into the United States. If Japan is included in the list of affected countries, the impact would be unavoidable.

“The seismic shift [in the industry] has become evident,” Mibe wrote in his New Year message to Honda employees.

Kato, meanwhile, said it is “difficult for one company to respond” to the shift to EVs and other changes.

Uchida said: “Our partners don’t necessarily have to be automakers. We want to discuss proposals from a variety of sources in a positive way.”

The three company heads share a common recognition that reorganization is essential if the country’s automobile industry, which is the backbone of the economy, is to continue to be competitive on the global stage. The weight of the companies’ choices has increased to an unprecedented level.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan