Tokyo Electric Power Company Holdings Inc.’s headquarters in Chiyoda Ward, Tokyo, on Sunday.

1:00 JST, August 9, 2022

July 31 marked the 10th year since Tokyo Electric Power Co. — renamed Tokyo Electric Power Company Holdings Inc. — was effectively nationalized.

Over the past decade, its restructuring has only reached the halfway point, despite its efforts to pay the cost of the accident at the Fukushima No. 1 nuclear power plant in 2011. The company improved business efficiency to raise funds for decommissioning and compensation costs, but the restart of its Kashiwazaki-Kariwa nuclear power plant in Niigata Prefecture has been delayed, and soaring fuel prices are squeezing its profits.

On July 31, 2012, TEPCO was effectively nationalized after receiving a capital injection of ¥1 trillion from the government-funded Nuclear Damage Compensation Facilitation Corporation — which has been reorganized and renamed the Nuclear Damage Compensation and Decommissioning Facilitation Corporation (NDF) — to avert bankruptcy. The NDF still holds more than 50% of the company’s voting rights.

After the effective nationalization, TEPCO cut staff numbers by 30% from that of fiscal 2010 to about 28,000 and also cut the payroll by 40% to about ¥260 billion, under the leadership of successive chairmen appointed by the government and outside parties. It strictly implemented cost reductions by raising the rate of competitive bidding to more than 60% for its repair work and material orders.

“After the March 11 earthquake, we had to implement painful reforms,” TEPCO Holdings’ Managing Executive Officer Momoko Nagasaki recalled. “The situation was such that if we didn’t do anything, we wouldn’t survive.”

In 2016, it became a holding company in order to speed up decision-making, with three operating subsidiaries under its umbrella: Fuel and Power (fuel procurement and thermal power generation), Power Grid (power supply) and Energy Partner (retail electricity business).

In 2019, many of its thermal power plants were consolidated into JERA Co., a power generation company equally owned by Chubu Electric Power Co.

Delay in plant restart

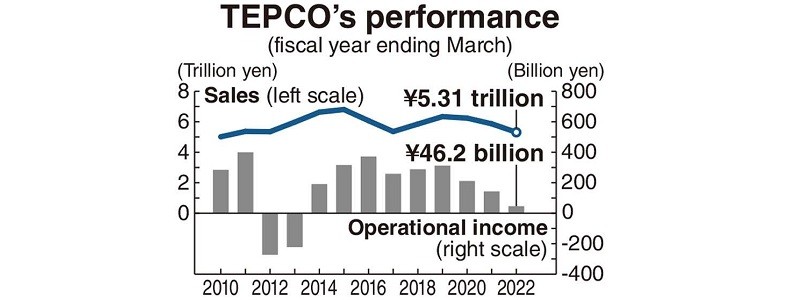

But business has not improved. TEPCO posted sales of ¥5.31 trillion for the fiscal year ending in March 2022 and operating income of ¥46.2 billion, both down for the third consecutive fiscal year. Rising fuel costs due to Russia’s invasion of Ukraine could further weaken its sales in fiscal 2023.

TEPCO will need to pay ¥15.9 trillion out of a total of ¥21.5 trillion for reactor decommissioning, compensation and decontamination of areas affected by the Fukushima accident.

After fiscal 2030, the company plans to pay ¥500 billion a year for decommissioning and compensation, and aims to secure an annual profit of ¥450 billion. However, there is no prospect of reaching this goal.

One cause of such poor performance is the delay in the restart of the Kashiwazaki-Kariwa nuclear power plant. Its Nos. 6 and 7 reactors passed safety inspections by the Nuclear Regulation Authority (NRA) in 2017, but the NRA issued a de facto operational ban in April 2021 after serious flaws in antiterrorism measures were discovered. TEPCO had expected a profit boost of about ¥50 billion per reactor per year, but it lost momentum to restart the reactors.

In March, the company announced a plan to relocate the functions of its headquarters’ nuclear division to inside the Kashiwazaki-Kariwa station and to Kashiwazaki City, and also to transfer 300 workers there who account for about 40% of the division’s manpower. The plan is aimed at increasing opportunities to hear from residents concerned directly. TEPCO is now being tested to see if it can pave the way for the restart of the reactors.

New business

In April, TEPCO announced plans to invest more than ¥9 trillion in decarbonization businesses such as renewable energy, positioning such new businesses as a pillar of its reconstruction.

“Ordinary profits are not enough to fulfill our responsibility to Fukushima,” a TEPCO executive said. “We’ll increase cooperation with other companies by using decarbonization as a starting point.”

A senior credit analyst at SMBC Nikko Securities Inc. said: “Under conventional management, TEPCO will lose competitiveness in the electricity market and profits will fall. Management should be conducted with a sense of unity, without dispersing management resources within the group.”

An artist illustration : TEPCO’s performance

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged