Bank of Japan Leaves Interest Rates Unchanged at 0.5 Percent; Impact of U.S. Tariffs, January Rate Hike Should be Assessed

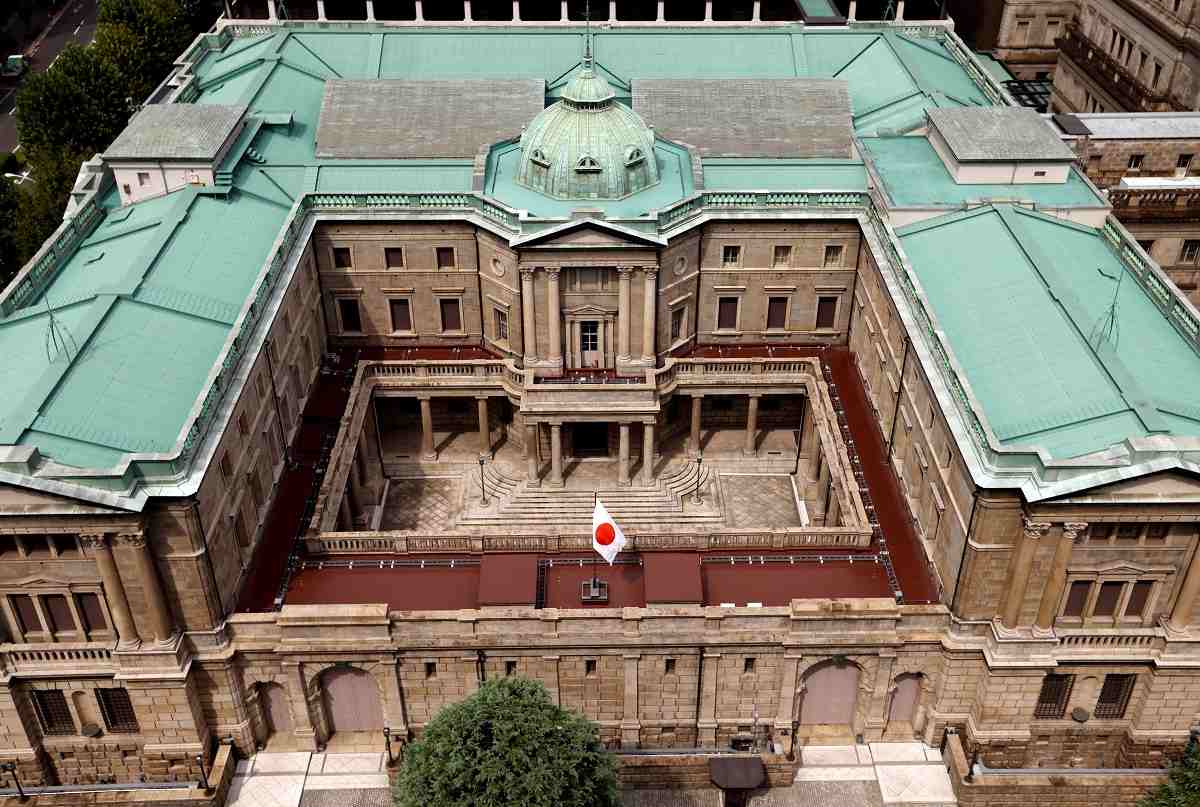

The Bank of Japan is seen in Tokyo in September 20, 2023.

14:54 JST, March 19, 2025

The Bank of Japan decided to leave policy interest rates unchanged at around 0.5% at its Monetary Policy Meeting on Wednesday.

It is believed that the BOJ considers it necessary to carefully assess the economic impact of the additional interest hike it decided on in January and the current U.S. policy of high tariffs.

At the previous Monetary Policy Meeting in January, the BOJ decided to raise the short-term interest rate guidance target to about 0.5% from about 0.25%. If the economic situation and inflation continue to develop in line with the BOJ’s expectations, the central bank intends to continue to raise the interest rate.

The year-on-year increase in the national consumer price index, excluding fresh food, was 3.2% in January, continuing to exceed the BOJ’s 2% target. However, there were some negative opinions within the BOJ about additional interest rate hikes over a short interval.

The CPI rate “doesn’t warrant raising interest rates at every [Monetary Policy Meeting],” Deputy Governor Shinichi Uchida said earlier this month.

The United States is poised to impose additional tariffs on automobiles imported from all countries and regions in April, which could hurt the Japanese auto industry. The BOJ appears to believe that it needs to spend a certain amount of time assessing the impact of the United States’ policies on the Japanese economy.

Related Tags

Top Articles in Business

-

Japan, Italy to Boost LNG Cooperation; Aimed at Diversifying Japan’s LNG Sources

-

Honda to Launch New Electric Motorbike in Vietnam

-

Asics Opens Factory for Onitsuka Tiger Brand in Western Japan

-

Japan’s ANA to Introduce Nationwide Logistics Service Using Drones, Will Be Used to Deliver Supplies in Remote Areas

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time