Japanese R&D Tax Credits to Support Artificial Intelligence, Robotics, Semiconductors, Other Strategic Tech

The ABCI 3.0 supercomputer at the National Institute of Advanced Industrial Science and Technology

17:07 JST, December 11, 2025

The government and the ruling coalition have entered the final stage of talks on expanding and introducing corporate tax breaks to support companies’ research and development and capital investment. For R&D spending on key technologies such as artificial intelligence, up to 40% or more of the investment amount would be deducted from corporate tax liabilities.

A new capital investment promotion tax system, allowing companies in all industries to deduct 7% of their capital outlays, will also be created. The measures will be written into the tax reform outline to be finalized by the end of the year.

For R&D investment, the enhanced tax incentives will apply to six fields the government designates as “national strategic technologies,” including “AI and advanced robotics” and “semiconductors and communications,” raising the ceiling on tax credits to as much as 40% of the investment amount — although for pre-approved joint research with universities and research institutions, the rate will be increased to as much as 50%.

For areas outside these six fields, the government will review the scheme by partially scaling back existing deduction rates and making other adjustments. Tax breaks will also be narrowed for R&D outsourced overseas, except in cases such as pharmaceutical companies conducting clinical trials abroad. The aim is to maintain and strengthen R&D bases within Japan.

The new capital investment promotion tax scheme will cover capital spending of at least ¥3.5 billion for large corporations and ¥500 million or more for small and midsize firms. Companies will be able to choose either a 7% tax credit or immediate expensing, under which the full amount of the investment can be booked as a cost in the first fiscal year. Investment plans formulated by the end of March 2029 will be eligible, and the tax relief is expected to total around ¥400 billion a year.

The government initially considered a more generous measure that would have raised the deduction rate to 15%, but shelved the idea because it would have overly expanded the scale of the tax cuts.

Global competition for leadership in key technologies such as semiconductors, quantum technology and nuclear fusion is intensifying, and the United States and Europe are also accelerating moves to strengthen tax incentives for capital investment.

In the United States, a permanent law allowing full and immediate expensing of capital investment costs was enacted in July this year. Germany has also passed a tax-cut package worth €46 billion (about ¥8.3 trillion), including future cuts to corporate taxes. Policymakers in Tokyo had feared that without comparable tax incentives, Japanese companies would shift more of their investment overseas.

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

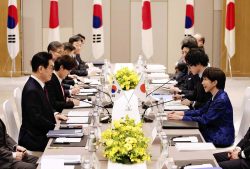

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time