Simultaneous Global Stock Market Plunge: Government, BOJ Should Heighten Their Sense of Caution

15:33 JST, August 7, 2024

The Nikkei Stock Average, which had been on the rise, plunged, triggering a simultaneous worldwide decline in stock values. The Nikkei average rebounded sharply the following day, but the turmoil in the financial markets continues.

It is hoped that the government and the Bank of Japan will increase their vigilance to ensure that the turmoil does not spread to the real economy.

The Nikkei average fell as much as 4,451 points on Aug. 5, the largest drop in its history. This exceeded the drop on Oct. 20, 1987, in response to the “Black Monday” stock market crash in the United States.

Stock prices also plunged in other Asian and European markets. In the United States, the Dow Jones Industrial Average of the New York Stock Exchange dropped over 1,000 points on Aug 5, the biggest decline in about a year and 11 months.

On Aug. 6, the Nikkei average turned around and rose 3,217 points to close at 34,675, the largest gain in its history. As the yen’s exchange rate against the dollar is fluctuating in foreign exchange markets, there are fears that the turmoil in the markets will continue.

If investor sentiment cools, things like private consumption and corporate capital investment could be adversely affected.

Hopefully, the government and the BOJ will closely monitor future developments to ensure the stability of financial markets. It is also important to strive to maintain close communication with overseas financial authorities.

The direct trigger for the global stock market plunge was uncertainty over the future of the U.S. economy. U.S. employment statistics fell significantly short of market expectations, intensifying concerns.

Stock prices in Japanese and U.S. markets had rapidly risen since the beginning of the year, but some had said the markets seemed overheated due to excessive optimism.

Expectations had been building for a “soft landing” of the economy, in which inflation would be contained without slowing down the economy even if the U.S. Federal Reserve Board continued to hold its policy interest rates at a high level. The fact that stocks related to semiconductors for generative artificial intelligence boosted market prices was also a significant factor behind the overheated markets.

In addition, foreign investors have been aggressively buying undervalued Japanese stocks, believing that the yen’s depreciation will continue due to the interest rate differential between Japan and the United States caused by the BOJ’s ultra-low interest rate policy.

However, it can be said that once optimism turned to pessimism — due to concerns about the U.S. economy, falling expectations for AI and the BOJ’s interest rate increases — the market became more volatile.

Meanwhile, the real economy and corporate performance in both Japan and the United States have been solid so far. It is essential to calmly face the situation without being overly pessimistic.

The administration of Prime Minister Fumio Kishida has been promoting policies to encourage people to shift their assets from savings to investments, such as the expansion of the Nippon Individual Savings Account (NISA) investment program in January this year, which exempts gains on small investments from tax.

The basic philosophy of NISA is to avoid risks and build up assets through long-term investment. The government should thoroughly explain it so that individual investors will not become dismayed.

(From The Yomiuri Shimbun, Aug. 7, 2024)

Top Articles in Editorial & Columns

-

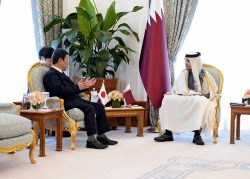

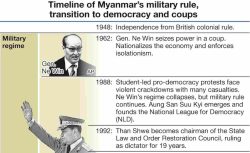

Myanmar Will Continue Under Military Rule Even After Election, Ex-Ambassador Maruyama Says in Exclusive Interview

-

40 Million Foreign Visitors to Japan: Urgent Measures Should Be Implemented to Tackle Overtourism

-

Expansion of New NISA: Devise Ways to Build up Household Assets

-

China Criticizes Sanae Takaichi, but China Itself Is to Blame for Worsening Relations with Japan

-

Withdrawal from International Organizations: U.S. Makes High-handed Move that Undermines Multilateral Cooperation

JN ACCESS RANKING

-

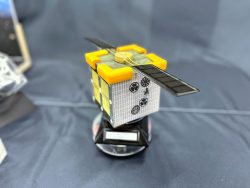

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time