‘Annual Income Barrier’ Could Be Lifted to ¥1.78 Million; Change Was First Agreed on in December 2024

The Liberal Democratic Party’s headquarters building in Tokyo

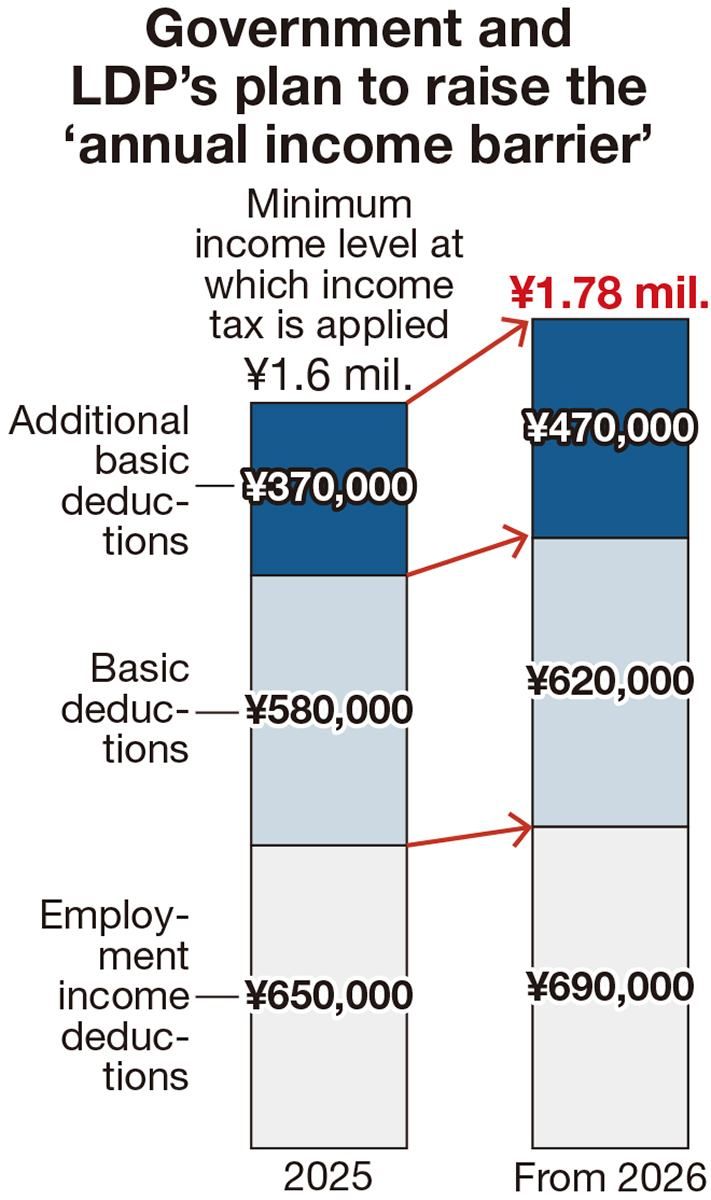

The government and the ruling Liberal Democratic Party intend to raise the “annual income barrier” — the income threshold for the imposition of income tax — from the current level of ¥1.6 million to ¥1.78 million.

The LDP, the Democratic Party for the People and Komeito originally agreed in December 2024 to seek this change. The government and the LDP will continue coordinating with the DPFP and other parties on this issue, aiming to raise the threshold as one of the tax system revisions for fiscal 2026, which starts in April.

Income tax rates range from 5% to 45%. The amount of income tax an individual must pay is calculated based on the total amount of income they earn after subtracting basic deductions, employment income deductions and other deductions. Until 2024, the threshold at which income tax was imposed for company employees and other salaried workers was set at ¥1.03 million, which was the combined minimum guaranteed amount of the basic and employment income deductions. This “¥1.03 million barrier” was widely criticized for supposedly encouraging people to work fewer hours to avoid paying taxes. Although the threshold was increased to ¥1.6 million from 2025, the DPFP has called for this figure to be bumped up further.

In light of demands by the DPFP and other factors, the government and the LDP plan to address rising prices by further raising the annual income barrier as part of the fiscal 2026 tax system revisions. The government and the LDP are aiming to introduce a system under which the basic and other deductions would be revised every two years, based on the rate at which consumer prices have increased since the last revision. Given that prices have increased by about 6% over the past two years, this would equate to the basic deductions being raised from the current ¥580,000 to ¥620,000. The minimum guaranteed amount of the employment income deductions would rise from ¥650,000 to ¥690,000.

Furthermore, the government and the LDP are arranging for the additional basic deductions for low-income earners to be increased from the current ¥370,000 by ¥100,000. This would bring the income tax threshold up to ¥1.78 million. This move would be a nod to the DPFP, which has pushed for the threshold to be brought to this level based on the rate of increase in the minimum wage in recent years.

However, the DPFP is seeking to have deductions increased for middle-income earners as well as for low-income earners, so whether the party can agree on the proposed changes will become a key focus of attention. The LDP and DPFP will continue working-level talks on matters such as to what level of income the increased deductions should be applied, with the aim of including their conclusions in the ruling parties’ outline of their planned tax system revisions, which could be compiled as soon as next week.

Discussions in fiscal 2025 between the then LDP-Komeito ruling coalition and the DPFP over tax system revisions such as raising the annual income barrier became bogged down over issues including finding new revenue sources. The ruling parties were forced to tweak their previously agreed-on tax system revisions and settled on a threshold of ¥1.6 million.

Top Articles in Politics

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time