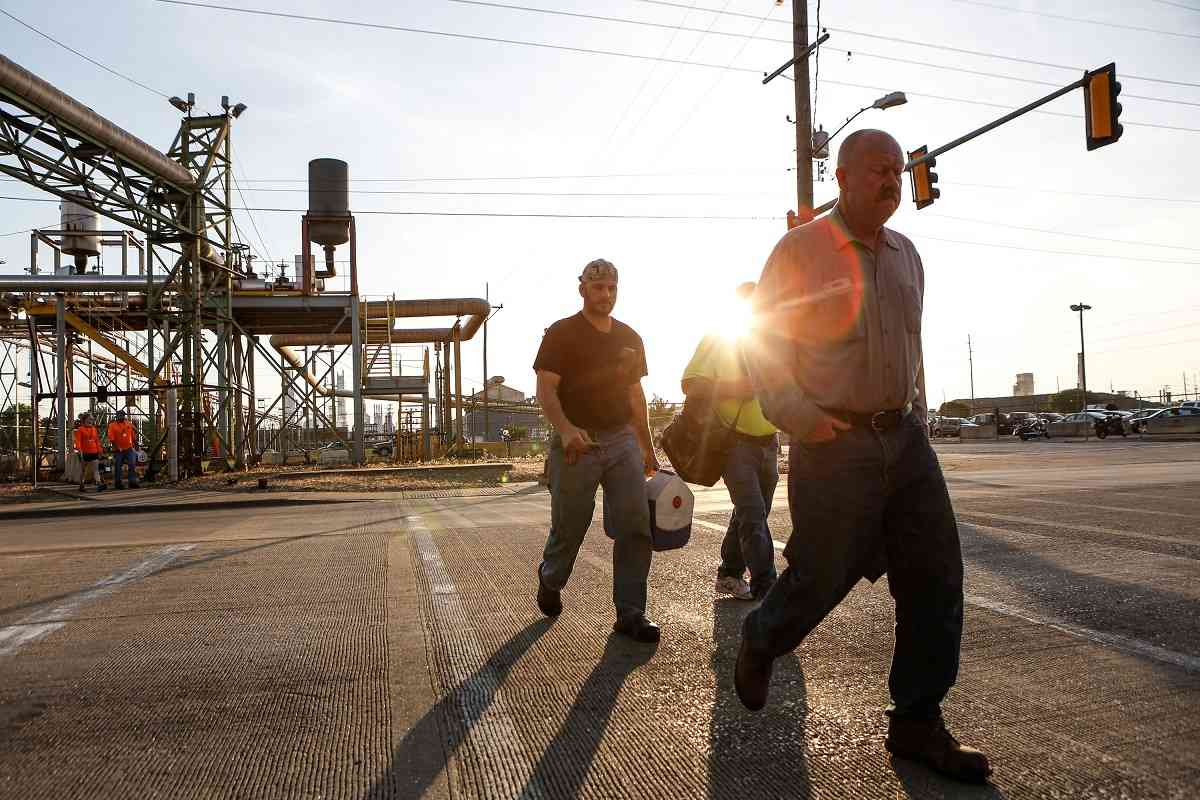

Steel workers return to work after a two-year idle at U.S. Steel Granite City Works in Granite City, Illinois, U.S., May 24, 2018.

13:47 JST, February 1, 2024

The prospect of a Japanese corporation buying U.S. Steel – whose products shaped American landmarks like the Empire State Building – is stirring an election-year debate over just how far the United States should go in embracing economic nationalism.

When Nippon Steel in December offered to buy the Pittsburgh-based steelmaker for $14.9 billion, investors cheered. But there was vocal opposition from the United Steelworkers union, which complained it had not been consulted, and prominent lawmakers in both parties, who objected to a foreign buyer swallowing a venerable American company. The loss of independence, they said, could threaten national security by leaving the United States short of steel in a crisis.

“I’m flat-out opposed to it,” Sen. J.D. Vance (R-Ohio) said in an interview. “And it’s not just this transaction I’m worried about. The precedent really matters.”

The deal also raises uncomfortable questions for the Biden administration, little more than nine months before the November election. The president, who often emphasizes the value of U.S. alliances, welcomes foreign investment. But permitting the purchase by Nippon Steel risks crossing organized labor, whose support he needs in vital swing states such as Pennsylvania.

The steel drama highlights tensions in the international economic policy that national security adviser Jake Sullivan unveiled last year. Biden’s trade and industrial policies – which some analysts describe as a form of economic nationalism – are designed to promote domestic production and to attract foreign cash to the United States.

In August, the White House hailed an uptick in foreign funding of new U.S. factories, which has nearly doubled from its pre-pandemic average. But now that Nippon Steel wants to invest here, the government is eyeing potential security concerns.

“It gets at some of the incoherence of the economic nationalist project,” said Scott Lincicome, a trade specialist at the Cato Institute.

Generous infrastructure spending, plus subsidies for semiconductor and clean-energy projects, will spur an estimated $3.5 trillion in combined public and private investment over the next decade, the administration says.

“We believe that our country – and our world – are safer, more resilient, and more prosperous because of the investment of foreign-owned companies in the United States,” the president said in a statement a few months after taking office.

Steel has long been one of the most protected U.S. markets. In 2018, President Donald Trump imposed 25 percent tariffs on all imported steel. Biden later negotiated a deal with the European Union to replace tariffs on its products with quotas. In December, he extended the deal until 2025.

But the barriers to imported steel effectively incentivize foreign companies to invest in domestic production, as Japanese automakers did in the early 1980s.

David Burritt, chief executive of U.S. Steel, said last fall that the company was benefiting from a trend of “accelerating de-globalization,” as nations reassessed the risks of interdependence. “The United States is experiencing a once-in-a-generation onshoring boom,” he told investors in October.

Trump, who appears likely to be the Republican nominee for president, has not commented publicly on Nippon Steel’s bid. But some of his allies want it killed.

“This is bulls–t. It can’t happen,” said Stephen K. Bannon of the “War Room” podcast, who was Trump’s chief White House strategist.

Some of the angst surrounding the Nippon Steel bid draws on memories of an age of American industrial might.

U.S. Steel is an iconic name with a storied corporate lineage. But it has been a long time since it was a genuinely iconic company.

It was established in 1901 through a merger of steel companies led by titans of American capitalism: John D. Rockefeller, J.P. Morgan, Andrew Carnegie and Charles M. Schwab.

U.S. Steel was the nation’s first billion-dollar corporation. The molten metal that emerged from its blast furnaces was molded into the tanks, planes and aircraft carriers that won World War II, as well as the automobiles and appliances that Americans bought in the postwar boom.

The company’s more recent history is less impressive. Now the third-largest steelmaker in the nation by revenue, trailing Cleveland-Cliffs and Nucor, U.S. Steel employs 22,740 workers, less than half as many as 20 years ago. The company lost money in nine of the last 15 years. Its annual output ranks 27th in the world, according to the World Steel Association. Nippon Steel’s ranks fourth.

The debate over Nippon Steel’s plan to acquire U.S. Steel echoes the 1980s, when Japanese companies snapped up American totems such as Rockefeller Center, the Pebble Beach golf course and Universal Studios. At the time, many Americans regarded the asset sales as a symptom of economic decline. Years later, it became clear that many of the Japanese buyers had overpaid for their American trophies.

For now, Biden can avoid choosing between political and economic imperatives. In announcing the deal last month, the companies said they would submit it to the Committee on Foreign Investment in the United States (CFIUS), an interagency body chaired by Treasury Secretary Janet L. Yellen, which scrutinizes foreign deals for potential national security impacts.

That has not yet happened, according to a person familiar with the situation who spoke on the condition of anonymity to discuss confidential matters. Executives plan to submit the paperwork to CFIUS by the end of next week, the person added. The panel deliberates behind closed doors and is expected to release its recommendation in months, though the process often slows.

Lael Brainard, the president’s national economic adviser, said last week at the Brookings Institution that the transaction deserved “serious scrutiny.” Robust domestic steel production is needed for the transition to a greener economy, the revitalization of domestic manufacturing and the development of more-resilient supply chains, according to an administration official who spoke on the condition of anonymity to discuss internal deliberations.

Whether the sale of the nation’s third-largest steel producer to a Japanese buyer imperils any of those goals remains to be determined.

“I’m not confident they’ll get past it,” said William Reinsch, a Commerce Department official in the Clinton administration. “It’s a political issue. This is an administration that looks at these things from a political perspective.”

The political considerations are obvious. The steelworkers union endorsed Biden in 2020 and has more than 1 million members, including tens of thousands in swing states such as Pennsylvania, Ohio, Michigan and Wisconsin.

David McCall, the union’s president, questioned Nippon Steel’s commitment to the union’s existing collective bargaining agreement.

“There’s no way it could work for us,” he said of the purchase, adding that he “does not object to the nationality of the owners. That doesn’t bother me.”

Opponents of the deal include Vance’s fellow Republican senators Josh Hawley of Missouri and Marco Rubio of Florida, as well as both of Pennsylvania’s Democratic senators, Bob Casey and John Fetterman, and Democratic senator Sherrod Brown of Ohio.

A Japanese-owned U.S. Steel would be “less responsive to U.S. national security needs,” Vance said. He also objects to allowing Nippon Steel to skirt U.S. tariffs on imported steel through the purchase and called for a blanket ban on any foreign purchaser of a U.S. company that benefits from such trade barriers.

“If they want access to U.S. markets and U.S. workers, they really have to ‘greenfield’ the investment here,” he said.

Critics’ national security objections seem exaggerated. The U.S. military each year needs just 3 percent of total domestic steel production, according to the Pentagon. Compared with decades ago, modern combat systems use less steel and more of other materials, such as titanium, aluminum and composites, according to Josh Spoores, steel industry analyst for CRU Group in Pittsburgh.

The Defense Department does not buy anything directly from U.S. Steel. The company said some customers that have both defense and commercial businesses might use its raw steel in military hardware.

“U.S. Steel’s manufacturing technologies and processes are not designed specifically for the production of steel with military applications, nor does U.S. Steel have any products, capability, or know-how that is specific to any U.S. government applications, including U.S. military applications,” the company said.

In 2022, Biden issued an executive order requiring CFIUS to take into account a transaction’s impact upon the resilience of U.S. supply chains – a concern that mushroomed after the pandemic and the outbreak of the war in Ukraine.

In recent years, CFIUS reviews of deals involving Chinese buyers have become especially controversial. But Japan is a U.S. treaty ally; if the country were attacked, the United States would be obligated to defend it. Nippon Steel already holds stakes in eight U.S. steel companies, which employ about 4,000 Americans.

“From a purely legal, national security perspective, it’s a deal that should get through,” said John Ingrassia, a partner at Proskauer, a New York-based law firm. “I see no reason it shouldn’t get resolved before the election.”

The Treasury-led committee will conduct its deliberations after receiving a classified assessment from the U.S. intelligence community. If the committee identifies specific concerns, it can draft a “mitigation agreement” requiring the buyer to take specific actions.

Nippon Steel executives have met with several lawmakers in an effort to ease their concerns. In those meetings, the executives promised that U.S. Steel will remain in Pittsburgh operating under its existing name, and that they are committed to the steelworkers’ collective bargaining agreement. No layoffs of salaried or union workers are in the offing, according to the person familiar with the situation.

The Japanese steelmaker, which operates 11 blast furnaces, expects to improve the efficiency of U.S. Steel’s furnaces while also reducing their carbon footprint, the person said.

But for now, both buyer and seller are hoping the CFIUS review will ultimately drown out “the political noise” surrounding the deal, said a second person familiar with the matter. “We’re going to trust in the process,” the person said.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan